-

Table of Contents

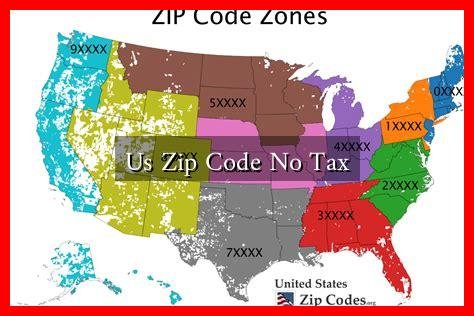

Understanding the Concept of “US Zip Code No Tax”

The phrase “US Zip Code No Tax” often refers to specific areas within the United States where residents or businesses may benefit from tax exemptions or reduced tax rates. This concept can be particularly appealing for individuals and companies looking to optimize their financial situations. In this article, we will explore the implications of living or operating in a no-tax zip code, the types of taxes that may be affected, and the potential benefits and drawbacks of such locations.

What is a No Tax Zip Code?

A no tax zip code typically refers to areas where certain taxes, such as state income tax or sales tax, are either non-existent or significantly reduced. While no area in the U.S. is completely free from all forms of taxation, some regions offer favorable tax conditions that can be advantageous for residents and businesses alike.

Types of Taxes Affected

When discussing no tax zip codes, it is essential to understand which types of taxes may be impacted.

. Here are the primary categories:

- State Income Tax: Some states, like Florida and Texas, do not impose a state income tax, making them attractive for high earners.

- Sales Tax: Certain areas may have reduced sales tax rates or exemptions for specific goods and services.

- Property Tax: Some localities offer property tax incentives to attract businesses or residents.

Examples of No Tax Zip Codes

Several states in the U.S. are known for their favorable tax conditions. Here are a few notable examples:

- Florida: With no state income tax, Florida is a popular destination for retirees and high-income earners.

- Texas: Similar to Florida, Texas does not have a state income tax, making it attractive for businesses and individuals.

- Wyoming: Known for its low taxes, Wyoming has no state income tax and low sales tax rates.

Case Studies: The Impact of No Tax Zip Codes

To illustrate the benefits of residing in a no tax zip code, consider the following case studies:

- Case Study 1: Florida Retiree – A retiree moving from New York to Florida can save thousands annually by avoiding state income tax, allowing for a more comfortable retirement.

- Case Study 2: Tech Startup in Texas – A tech startup relocating to Austin, Texas, benefits from no state income tax, which allows them to reinvest more into their business and attract top talent.

Potential Drawbacks of No Tax Zip Codes

While the benefits of living in a no tax zip code are appealing, there are potential drawbacks to consider:

- Quality of Services: Areas with low taxes may have fewer public services, such as education and infrastructure.

- Higher Local Taxes: Some regions may compensate for the lack of state income tax with higher local taxes or fees.

- Cost of Living: Popular no tax areas may have a higher cost of living, offsetting some of the tax savings.

Conclusion: Weighing the Pros and Cons

In summary, the concept of “US Zip Code No Tax” can offer significant financial advantages for individuals and businesses. States like Florida, Texas, and Wyoming provide opportunities to minimize tax burdens, making them attractive destinations for relocation. However, it is crucial to weigh the benefits against potential drawbacks, such as reduced public services and higher local taxes. Ultimately, understanding the implications of living in a no tax zip code can help individuals and businesses make informed decisions about their financial futures.

For more information on tax laws and regulations, you can visit the IRS website.