-

Table of Contents

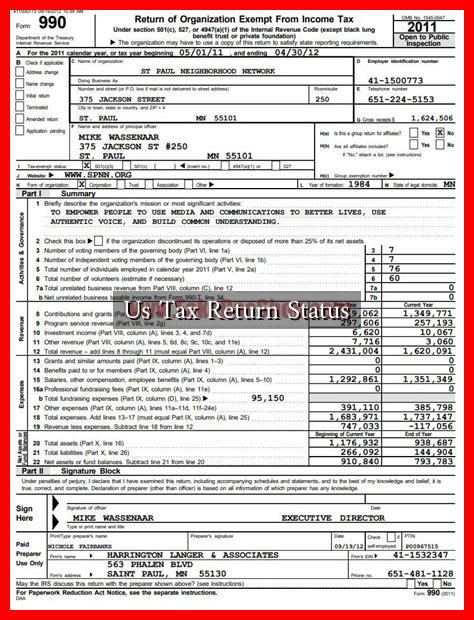

Understanding Your U.S. Tax Return Status

Filing taxes can be a daunting task for many Americans, but understanding your tax return status is crucial for ensuring compliance and maximizing potential refunds. This article will explore the various aspects of U.S. tax return status, including how to check it, what it means, and the implications of different statuses.

What is Tax Return Status?

Your tax return status refers to the current state of your filed tax return with the Internal Revenue Service (IRS).

. It indicates whether your return has been received, processed, or if there are any issues that need to be addressed. Understanding your tax return status can help you manage your finances better and avoid potential penalties.

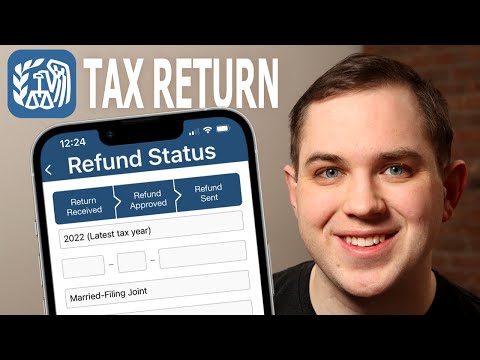

How to Check Your Tax Return Status

Checking your tax return status is a straightforward process. The IRS provides several methods for taxpayers to verify their status:

- Online: The IRS offers a “Where’s My Refund?” tool on their website, which allows you to check the status of your refund. You will need to provide your Social Security number, filing status, and the exact amount of your refund.

- Mobile App: The IRS2Go app is available for download on both iOS and Android devices, providing a convenient way to check your refund status on the go.

- Phone: You can call the IRS at 1-800-829-1040 for assistance, although wait times may vary.

Understanding Different Tax Return Statuses

When you check your tax return status, you may encounter several different statuses. Here are the most common ones:

- Received: This status indicates that the IRS has received your tax return but has not yet processed it.

- Processing: Your return is currently being processed by the IRS. This can take several weeks, especially during peak tax season.

- Approved: Your return has been processed, and your refund has been approved. You can expect to receive your refund within a few days if you opted for direct deposit.

- Rejected: If there are issues with your return, such as incorrect information or missing forms, it may be rejected. You will need to correct the errors and resubmit your return.

Common Issues Affecting Tax Return Status

Several factors can affect the status of your tax return. Understanding these issues can help you avoid delays and ensure a smoother filing process:

- Incorrect Information: Errors in your Social Security number, filing status, or income can lead to delays or rejections.

- Missing Forms: Failing to include necessary forms, such as W-2s or 1099s, can result in processing issues.

- Identity Verification: The IRS may require additional verification if they suspect identity theft or fraud, which can delay your refund.

Case Study: The Impact of Filing Errors

Consider the case of John, a taxpayer who filed his return online. He mistakenly entered the wrong Social Security number for his dependent. As a result, his return was flagged for review, and he faced a delay of over six weeks in receiving his refund. This situation highlights the importance of double-checking all information before submission.

Statistics on Tax Return Processing

According to the IRS, in the 2022 tax season, approximately 90% of taxpayers received their refunds within 21 days of filing electronically. However, those who filed paper returns experienced longer wait times, with some taking up to six weeks or more to process. This emphasizes the benefits of e-filing for quicker refunds.

Conclusion

Understanding your U.S. tax return status is essential for effective financial management and compliance with tax laws. By knowing how to check your status and what different statuses mean, you can navigate the tax filing process more efficiently. Remember to double-check your information to avoid common issues that can delay your refund. For more information, visit the IRS website.

In summary, staying informed about your tax return status can save you time and stress, ensuring that you receive any refunds promptly and without complications.