-

Table of Contents

Understanding the US Tax Quiz: A Comprehensive Guide

Taxes are an integral part of American life, yet they often remain a mystery to many citizens. The US tax system is complex, with various rules, regulations, and deductions that can confuse even the most diligent taxpayers. To help demystify this topic, we present the “US Tax Quiz,” a tool designed to educate individuals about their tax obligations and rights. This article will explore the importance of tax knowledge, common misconceptions, and provide a quiz to test your understanding.

The Importance of Tax Knowledge

Understanding taxes is crucial for several reasons:

- Financial Planning: Knowledge of tax laws can help individuals make informed financial decisions, such as retirement planning and investment strategies.

- Maximizing Deductions: Familiarity with available deductions and credits can lead to significant savings.

- Avoiding Penalties: Understanding tax obligations helps prevent costly mistakes that can result in penalties or audits.

According to a 2021 survey by the National Endowment for Financial Education, only 24% of Americans felt confident in their understanding of taxes. This statistic highlights the need for educational resources like the US Tax Quiz.

Common Misconceptions About Taxes

Many taxpayers hold misconceptions that can lead to confusion and errors.

. Here are some prevalent myths:

- Myth 1: “I don’t need to file taxes if I don’t earn much.”

Fact: Even if your income is below the filing threshold, you may still need to file to claim refundable credits. - Myth 2: “All my income is taxable.”

Fact: Certain types of income, such as gifts or inheritances, may not be taxable. - Myth 3: “I can deduct all my expenses.”

Fact: Only certain expenses are deductible, and they must meet specific criteria.

Understanding these misconceptions can help taxpayers navigate their obligations more effectively.

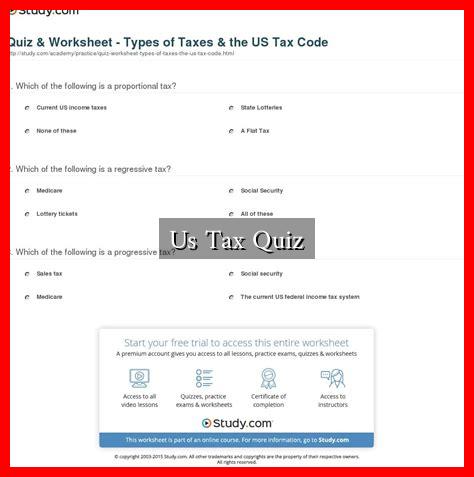

The US Tax Quiz: Test Your Knowledge

Now that we’ve covered the importance of tax knowledge and common misconceptions, it’s time to put your understanding to the test. Below is a sample quiz that covers various aspects of the US tax system:

- Question 1: What is the deadline for filing federal income tax returns?

- Question 2: Which of the following is a refundable tax credit?

a) Child Tax Credit

b) Mortgage Interest Deduction

c) Charitable Contribution Deduction - Question 3: True or False: You can deduct personal expenses on your federal tax return.

Answers: 1) April 15, 2) a) Child Tax Credit, 3) False.

Case Studies: Real-Life Tax Scenarios

To further illustrate the importance of tax knowledge, consider the following case studies:

- Case Study 1: Sarah, a freelance graphic designer, was unaware of the self-employment tax. After receiving a notice from the IRS, she realized she owed more than she anticipated. By educating herself on self-employment taxes, she was able to plan better for future tax seasons.

- Case Study 2: John and Lisa, a married couple, thought they could not claim any deductions because they both worked full-time. After taking the US Tax Quiz, they discovered they were eligible for the Earned Income Tax Credit, resulting in a significant refund.

Conclusion: Empowering Yourself Through Tax Knowledge

Understanding the US tax system is essential for every citizen. The US Tax Quiz serves as a valuable resource to enhance your knowledge and confidence in handling tax-related matters. By debunking common misconceptions and providing a platform for self-assessment, individuals can better navigate their financial responsibilities.

In summary, being informed about taxes not only helps in maximizing deductions and avoiding penalties but also empowers individuals to make sound financial decisions. For more information on tax education, consider visiting the IRS Education page.