-

Table of Contents

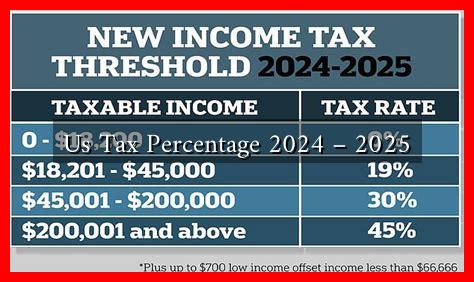

US Tax Percentage 2024 – 2025: What You Need to Know

As the United States approaches the 2024-2025 tax year, understanding the tax landscape is crucial for individuals and businesses alike. With potential changes in tax legislation, it’s essential to stay informed about the tax percentages that will affect your financial planning. This article delves into the expected tax rates, potential changes, and strategies for effective tax management.

Current Tax Structure Overview

The US tax system is progressive, meaning that tax rates increase as income rises. For the 2023 tax year, the federal income tax brackets are as follows:

- 10% on income up to $11,000 for single filers

- 12% on income over $11,000 to $44,725

- 22% on income over $44,725 to $95,375

- 24% on income over $95,375 to $182,100

- 32% on income over $182,100 to $231,250

- 35% on income over $231,250 to $578,125

- 37% on income over $578,125

These brackets are adjusted annually for inflation, and taxpayers should be aware of how these changes can impact their tax liabilities.

Projected Changes for 2024-2025

While the exact tax percentages for 2024-2025 have not yet been finalized, several factors could influence potential changes:

- Inflation Adjustments: The IRS typically adjusts tax brackets and standard deductions based on inflation. For 2024, taxpayers can expect slight increases in the income thresholds for each bracket.

- Legislative Changes: The political landscape can significantly impact tax policy.

. Depending on the outcomes of the 2024 elections, new tax laws could be enacted that alter rates or introduce new deductions and credits.

- Economic Conditions: Economic recovery post-pandemic may lead to discussions about tax reforms aimed at stimulating growth or addressing budget deficits.

State Taxes: A Critical Component

In addition to federal taxes, state taxes play a significant role in the overall tax burden. Each state has its own tax rates and structures, which can vary widely. For example:

- California: Has a progressive tax system with rates ranging from 1% to 13.3%.

- Texas: Does not impose a state income tax, relying instead on sales and property taxes.

- New York: Features a progressive tax system with rates from 4% to 10.9%.

Taxpayers should consider both federal and state tax implications when planning their finances for 2024-2025.

Strategies for Tax Efficiency

As taxpayers prepare for the upcoming tax years, implementing effective tax strategies can help minimize liabilities:

- Maximize Deductions: Take advantage of available deductions, such as mortgage interest, student loan interest, and charitable contributions.

- Contribute to Retirement Accounts: Contributions to 401(k)s and IRAs can reduce taxable income while saving for retirement.

- Consider Tax Credits: Explore eligibility for tax credits, such as the Earned Income Tax Credit (EITC) or Child Tax Credit, which can directly reduce tax owed.

Conclusion

As we look ahead to the 2024-2025 tax years, understanding the current tax structure and potential changes is vital for effective financial planning. With the possibility of inflation adjustments, legislative changes, and varying state tax rates, taxpayers must stay informed and proactive. By employing strategic tax planning and maximizing deductions and credits, individuals and businesses can navigate the complexities of the tax system more effectively.

For more detailed information on tax rates and updates, visit the IRS website.