-

Table of Contents

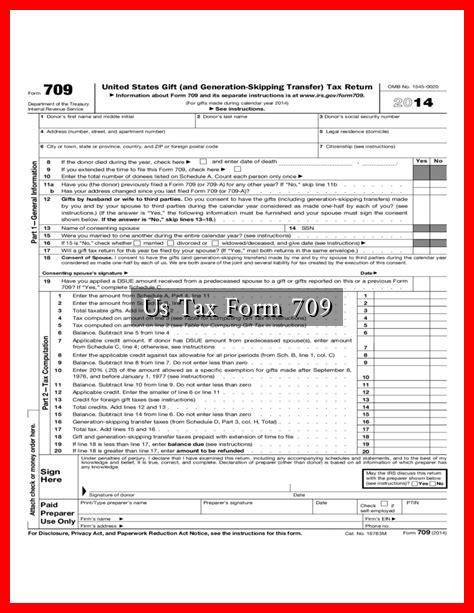

Understanding US Tax Form 709: A Comprehensive Guide

Taxation in the United States can be a complex and daunting subject, especially when it comes to gift and estate taxes. One of the key forms involved in this process is the US Tax Form 709, also known as the United States Gift (and Generation-Skipping Transfer) Tax Return. This article aims to demystify Form 709, explaining its purpose, requirements, and implications for taxpayers.

What is Form 709?

Form 709 is used to report gifts made during the tax year that exceed the annual exclusion limit. The IRS requires this form to ensure that individuals comply with federal gift tax laws. The form also addresses generation-skipping transfers, which involve gifts made to individuals who are two or more generations younger than the donor.

Who Needs to File Form 709?

Not everyone is required to file Form 709.

. Here are the primary circumstances under which you must file:

- If you make a gift to an individual that exceeds the annual exclusion limit, which is $17,000 for 2023.

- If you make a gift to a spouse who is not a U.S. citizen, regardless of the amount.

- If you make a generation-skipping transfer, regardless of the amount.

It’s important to note that even if you do not owe any gift tax, you are still required to file Form 709 if your gifts exceed the annual exclusion limit.

Understanding the Annual Exclusion and Lifetime Exemption

The annual exclusion allows individuals to gift a certain amount each year without incurring gift tax. For 2023, this amount is set at $17,000 per recipient. This means you can give up to $17,000 to as many individuals as you wish without needing to file Form 709.

In addition to the annual exclusion, there is a lifetime exemption amount, which is the total amount you can give over your lifetime without incurring gift tax. As of 2023, this exemption is $12.92 million. Gifts exceeding this amount may be subject to taxation.

Filing Process for Form 709

Filing Form 709 can be intricate, but understanding the process can simplify it. Here are the steps involved:

- Gather Information: Collect details about the gifts you made during the year, including the recipient’s name, relationship, and the value of the gift.

- Complete the Form: Fill out Form 709 accurately, ensuring that all required information is included.

- File the Form: Submit Form 709 to the IRS by April 15 of the year following the gift. If you file for an extension for your income tax return, it also extends the deadline for Form 709.

Common Mistakes to Avoid

When filing Form 709, taxpayers often make several common mistakes. Here are a few to watch out for:

- Failing to file when required, which can lead to penalties.

- Incorrectly calculating the value of gifts, especially for non-cash assets.

- Not considering the implications of generation-skipping transfers.

Case Study: The Importance of Filing Form 709

Consider the case of John, who gifted $50,000 to his daughter in 2023. Since this amount exceeds the annual exclusion limit of $17,000, John is required to file Form 709. By doing so, he can utilize part of his lifetime exemption, ensuring that he does not incur any immediate tax liability. If John fails to file, he may face penalties and complications in future estate planning.

Conclusion

US Tax Form 709 plays a crucial role in the landscape of gift and estate taxation. Understanding when and how to file this form can save taxpayers from potential penalties and ensure compliance with federal tax laws. By being aware of the annual exclusion and lifetime exemption, individuals can make informed decisions about their gifting strategies. For more detailed information, you can visit the IRS website.

In summary, whether you are planning to make significant gifts or simply want to understand your tax obligations better, being informed about Form 709 is essential for effective financial planning.