-

Table of Contents

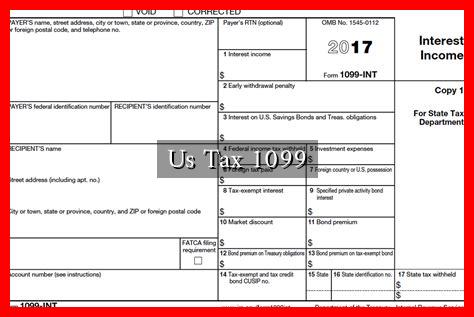

Understanding the US Tax 1099 Form: A Comprehensive Guide

The 1099 form is a crucial component of the U.S. tax system, serving as a record of income received by individuals and businesses that are not classified as wages. This article delves into the various types of 1099 forms, their significance, and how they impact taxpayers. Whether you are a freelancer, a small business owner, or simply curious about your tax obligations, understanding the 1099 form is essential.

What is a 1099 Form?

The 1099 form is an information return used by the Internal Revenue Service (IRS) to track income that is not reported on a W-2 form. While W-2 forms are issued to employees, 1099 forms are typically issued to independent contractors, freelancers, and other non-employees.

. The form reports various types of income, including but not limited to:

- Non-employee compensation

- Interest income

- Dividends

- Rental income

- Proceeds from broker transactions

Types of 1099 Forms

There are several variations of the 1099 form, each designated for specific types of income. Here are some of the most common types:

- 1099-MISC: Used for reporting miscellaneous income, including payments to independent contractors.

- 1099-NEC: Specifically for reporting non-employee compensation, reintroduced in 2020.

- 1099-INT: Reports interest income earned from banks or other financial institutions.

- 1099-DIV: Used to report dividends and distributions from investments.

- 1099-R: Reports distributions from retirement accounts.

Who Needs to File a 1099 Form?

Generally, businesses and individuals must file a 1099 form if they have paid $600 or more to a non-employee for services rendered during the tax year. This includes payments made to freelancers, independent contractors, and other service providers. However, there are exceptions and specific thresholds for different types of income. For example:

- For interest income, a 1099-INT must be issued if the amount is $10 or more.

- For dividends, a 1099-DIV is required if the total dividends paid are $10 or more.

Filing Deadlines and Requirements

Filing deadlines for 1099 forms can vary based on the type of form and the method of submission. Generally, the following deadlines apply:

- Paper Filing: February 28 of the year following the tax year.

- Electronic Filing: March 31 of the year following the tax year.

- Recipient Copy: Must be sent to the recipient by January 31.

It is essential to ensure that the information reported on the 1099 form is accurate to avoid penalties from the IRS. Businesses should also keep copies of all 1099 forms filed for at least three years.

Common Mistakes to Avoid

When dealing with 1099 forms, taxpayers often make several common mistakes. Here are some pitfalls to avoid:

- Failing to issue a 1099 when required.

- Incorrectly reporting the recipient’s Tax Identification Number (TIN).

- Not sending the recipient’s copy on time.

- Misclassifying workers as independent contractors instead of employees.

Conclusion

Understanding the 1099 form is vital for anyone involved in freelance work, independent contracting, or business operations. By knowing the different types of 1099 forms, who needs to file them, and the associated deadlines, taxpayers can ensure compliance with IRS regulations and avoid costly penalties. As the gig economy continues to grow, the importance of accurately reporting income through 1099 forms will only increase. For more detailed information, you can visit the IRS website.

In summary, the 1099 form is not just a bureaucratic requirement; it is a critical tool for maintaining transparency in income reporting. By staying informed and organized, taxpayers can navigate the complexities of the tax system with confidence.