-

Table of Contents

Taxes: The United States vs. Switzerland

Taxation is a critical aspect of any economy, influencing everything from individual financial decisions to corporate strategies. The United States and Switzerland represent two distinct approaches to taxation, each with its own implications for residents and businesses. This article explores the key differences between the tax systems of these two countries, providing insights into their structures, rates, and impacts on citizens and the economy.

Overview of the Tax Systems

The tax systems in the United States and Switzerland are fundamentally different in terms of structure, rates, and administration.

. Understanding these differences is essential for individuals and businesses operating in or considering relocation to either country.

United States Tax System

The U.S. tax system is characterized by a progressive income tax structure, where tax rates increase with income. Key features include:

- Federal Income Tax: Ranges from 10% to 37% based on income brackets.

- State and Local Taxes: Vary significantly by state, with some states imposing no income tax (e.g., Texas, Florida) while others can have rates exceeding 13% (e.g., California).

- Capital Gains Tax: Taxed at different rates depending on the holding period of the asset, with long-term gains generally taxed at lower rates.

- Corporate Tax: The federal corporate tax rate is currently set at 21%, with additional state taxes applicable.

In addition to income taxes, Americans also pay payroll taxes, property taxes, and various sales taxes, contributing to a complex tax landscape.

Switzerland Tax System

Switzerland’s tax system is known for its simplicity and efficiency. Key features include:

- Federal Income Tax: Progressive rates ranging from 0% to 11.5%.

- Cantonal and Municipal Taxes: Each canton has its own tax rates, which can lead to significant variations; for example, Zurich has a higher tax rate compared to Zug, which is known for its low taxes.

- Wealth Tax: Imposed at the cantonal level, typically ranging from 0.1% to 1% on net wealth.

- Corporate Tax: Generally lower than in the U.S., with an average effective rate of around 15% to 18% depending on the canton.

Switzerland’s decentralized system allows for a high degree of local autonomy, which can lead to competitive tax rates among cantons, attracting both individuals and businesses.

Comparative Analysis of Tax Rates

When comparing tax rates between the U.S. and Switzerland, several factors come into play, including the overall tax burden and the impact on disposable income.

Income Tax Rates

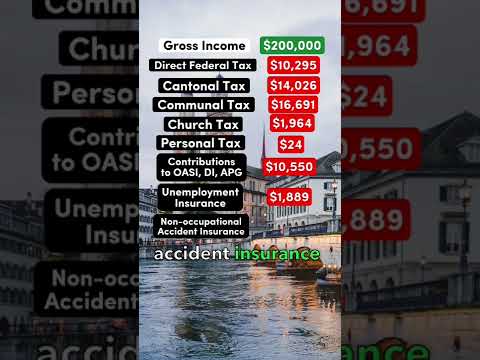

In the U.S., the federal income tax can be quite high for high earners, especially when combined with state taxes. For example, a single filer earning $200,000 could face an effective tax rate of around 30% or more when considering federal and state taxes.

In contrast, a similar income in Switzerland might be taxed at a lower overall rate, especially if the individual resides in a canton with favorable tax policies. For instance, a high earner in Zug might pay an effective rate closer to 20% or less.

Corporate Tax Rates

Corporations in the U.S. face a federal tax rate of 21%, but state taxes can add significantly to this burden. In Switzerland, the effective corporate tax rate is generally lower, making it an attractive destination for multinational companies.

Implications for Residents and Businesses

The differences in tax systems have significant implications for residents and businesses in both countries.

- Cost of Living: Higher taxes in the U.S. can lead to a higher cost of living, particularly in states with high income taxes.

- Business Environment: Switzerland’s lower corporate tax rates and stable economy make it a favorable location for international businesses.

- Quality of Life: Swiss residents often enjoy a higher quality of life, supported by efficient public services funded by taxes.

Conclusion

In summary, the tax systems of the United States and Switzerland reflect their unique economic philosophies and governance structures. The U.S. system is characterized by higher progressive tax rates and a complex structure, while Switzerland offers a more streamlined and competitive tax environment. For individuals and businesses considering relocation or investment, understanding these differences is crucial for making informed financial decisions. Ultimately, the choice between the two systems will depend on personal circumstances, financial goals, and lifestyle preferences.

For further reading on international tax comparisons, you can visit OECD Taxation.