-

Table of Contents

Understanding the Tax Rate for an Income of $75,000 in the U.S.

Taxation is a critical aspect of personal finance that affects individuals and families across the United States. For those earning an annual income of $75,000, understanding the tax implications is essential for effective financial planning. This article delves into the federal tax rates, state taxes, deductions, and credits that can influence the overall tax burden for someone earning this income level.

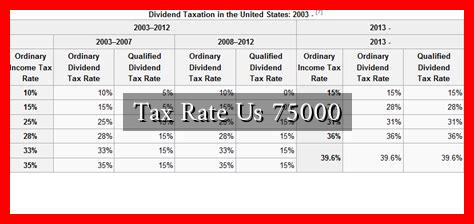

Federal Tax Rates for 2023

The federal income tax system in the U.S. is progressive, meaning that tax rates increase as income rises. For the tax year 2023, the federal tax brackets are as follows:

- 10% on income up to $11,000

- 12% on income over $11,000 and up to $44,725

- 22% on income over $44,725 and up to $95,375

For an individual earning $75,000, the federal tax calculation would be as follows:

- 10% on the first $11,000: $1,100

- 12% on the next $33,725 ($44,725 – $11,000): $4,047

- 22% on the remaining $30,275 ($75,000 – $44,725): $6,661

Adding these amounts together, the total federal tax liability would be approximately $11,808.

. However, this figure can be reduced through various deductions and credits.

State Income Taxes

In addition to federal taxes, individuals must also consider state income taxes, which vary significantly across the country. Some states have a flat tax rate, while others employ a progressive tax system similar to the federal government. Here are a few examples:

- California: Progressive rates ranging from 1% to 13.3%

- Texas: No state income tax

- New York: Progressive rates ranging from 4% to 10.9%

For a $75,000 income, the state tax burden can vary widely. For instance, a resident in California might pay around $3,000 in state taxes, while someone in Texas would pay none.

Deductions and Credits

Tax deductions and credits can significantly impact the overall tax liability. Here are some common deductions and credits that may apply:

- Standard Deduction: For 2023, the standard deduction for single filers is $13,850. This reduces taxable income, lowering the overall tax burden.

- Retirement Contributions: Contributions to retirement accounts like a 401(k) or IRA can be deducted from taxable income.

- Education Credits: If you are paying for education, credits like the American Opportunity Credit can reduce your tax bill.

By utilizing the standard deduction, an individual earning $75,000 would effectively reduce their taxable income to $61,150, which would lower their federal tax liability significantly.

Case Study: Tax Liability for a $75,000 Income

Let’s consider a hypothetical individual, Jane, who lives in California and earns $75,000 annually. After applying the standard deduction, her taxable income is $61,150. Here’s how her tax liability breaks down:

- Federal Tax: Approximately $8,000 after deductions

- State Tax: Approximately $3,000

Jane’s total tax liability would be around $11,000, which is a significant portion of her income but manageable with proper planning.

Conclusion

Understanding the tax implications of earning $75,000 in the U.S. is crucial for effective financial management. With a progressive tax system, state taxes, and various deductions and credits, the actual tax burden can vary widely. By being informed and utilizing available resources, individuals can optimize their tax situation and retain more of their hard-earned income. For more detailed information on tax rates and planning, consider visiting the IRS website.