-

Table of Contents

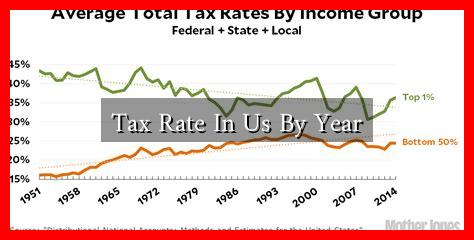

Tax Rate in the U.S. by Year: A Historical Overview

Understanding the evolution of tax rates in the United States is crucial for grasping the broader economic landscape and the fiscal policies that have shaped the nation. Tax rates have fluctuated significantly over the years, influenced by various factors including economic conditions, political ideologies, and social needs. This article delves into the historical changes in tax rates, providing insights into how these changes have impacted American citizens and the economy.

The Evolution of Federal Income Tax Rates

The federal income tax system in the U.S.

. has undergone numerous changes since its inception in the early 20th century. The 16th Amendment, ratified in 1913, allowed Congress to levy an income tax without apportioning it among the states. Here’s a brief overview of key changes in tax rates over the decades:

- 1913-1920s: The first federal income tax rates were relatively low, starting at 1% for incomes over $3,000. By the end of the 1920s, the top rate had risen to 25%.

- 1930s-1940s: The Great Depression prompted significant tax increases. The top rate soared to 94% during World War II, reflecting the need for government revenue to fund the war effort.

- 1950s-1960s: The post-war economy saw a gradual reduction in tax rates, with the top rate settling at around 91% during the 1950s.

- 1980s: The Reagan administration implemented significant tax cuts, reducing the top rate from 70% to 28% by the end of the decade.

- 1990s-2000s: Tax rates fluctuated, with the top rate increasing to 39.6% under President Clinton and remaining until the Bush tax cuts in the early 2000s.

- 2010s-Present: The Tax Cuts and Jobs Act of 2017 lowered the top rate to 37%, which remains in effect today.

Impact of Tax Rate Changes on the Economy

Changes in tax rates have profound implications for the economy, influencing consumer behavior, business investment, and overall economic growth. Here are some key impacts:

- Consumer Spending: Lower tax rates generally increase disposable income, leading to higher consumer spending. For instance, the tax cuts in the 1980s spurred economic growth by encouraging consumer expenditure.

- Business Investment: Reducing corporate tax rates can incentivize businesses to invest in expansion and job creation. The 2017 tax cuts aimed to stimulate investment by lowering the corporate tax rate from 35% to 21%.

- Income Inequality: Tax policy can also affect income distribution. Higher tax rates on the wealthy can help reduce income inequality, while lower rates may exacerbate it.

Case Studies: Tax Rate Changes and Their Outcomes

Several case studies illustrate the effects of tax rate changes on the economy:

- The Reagan Tax Cuts (1981): The Economic Recovery Tax Act of 1981 significantly reduced tax rates, leading to a period of robust economic growth, albeit accompanied by increased deficits.

- The Clinton Tax Increase (1993): The increase in the top tax rate to 39.6% was followed by a period of budget surpluses and economic expansion, demonstrating that higher taxes can coexist with economic growth.

- The Tax Cuts and Jobs Act (2017): This act aimed to stimulate the economy through lower corporate taxes, but critics argue it disproportionately benefited the wealthy and increased the national deficit.

Conclusion: The Future of Tax Rates in the U.S.

The history of tax rates in the United States reflects a complex interplay of economic needs, political agendas, and social priorities. As the nation faces new challenges, including economic inequality and funding for social programs, the debate over tax rates will continue to be a pivotal issue. Understanding past trends can provide valuable insights into future tax policy decisions.

For more detailed information on U.S. tax history, you can visit the IRS Historical Data.

In summary, tax rates in the U.S. have evolved significantly over the years, shaped by historical events and policy decisions. As we look to the future, the ongoing discussions about tax reform will undoubtedly play a crucial role in shaping the economic landscape of the nation.