Table of ContentsUnderstanding an $80,000 Salary After Tax in the U.S.Federal Income Tax OverviewState Income Tax ConsiderationsOther Deductions and ConsiderationsCalculating…

Browsing: USA

USA

Table of ContentsUnderstanding $80,000 After Tax in the U.S.: A Comprehensive GuideBreaking Down the Tax BracketsState Taxes: A Variable ComponentDeductions…

Table of ContentsUnderstanding US Tax Form 893: A Comprehensive GuideWhat is IRS Form 893?Key Features of Form 893Who Should File…

Table of ContentsUnderstanding U.S. Tax Code Section 83: A Comprehensive GuideWhat is Section 83?Key Concepts of Section 83Taxation Timing Under…

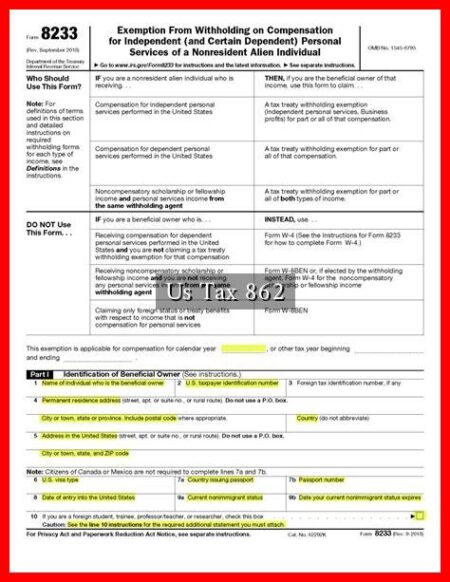

Table of ContentsUnderstanding US Tax Form 862: A Comprehensive GuideWhat is US Tax Form 862?Why is Form 862 Important?Who Needs…

Table of ContentsUnderstanding IRS Form 894: A Comprehensive GuideWhat is IRS Form 894?Who Needs to File Form 894?How to Complete…

Table of ContentsUnderstanding US Tax 871(m): A Comprehensive GuideWhat is Section 871(m)?Key Features of Section 871(m)Who is Affected by Section…

Table of ContentsUnderstanding US Tax Form 892: A Comprehensive GuideWhat is IRS Form 892?Why is Form 892 Important?Who Needs to…

Table of ContentsUnderstanding the 871 M US Tax: A Comprehensive GuideWhat is the 871 M Tax?Key Features of the 871…

Table of ContentsUnderstanding US Tax Form 8843: A Comprehensive GuideWhat is IRS Form 8843?Who Needs to File Form 8843?Filing Requirements…