-

Table of Contents

Understanding the 1099 Form: A Comprehensive Guide

As tax season approaches, many individuals and businesses are familiar with the W-2 form, which reports an employee’s annual wages and the amount of taxes withheld by their employer. However, for independent contractors, freelancers, and other self-employed individuals, the 1099 form plays a crucial role in reporting income to the IRS. In this article, we will delve into what the 1099 form is, who needs to file it, and why it is essential for tax compliance.

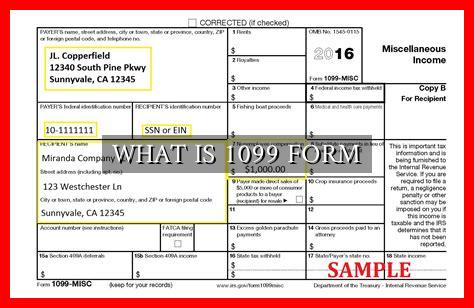

What is a 1099 Form?

A 1099 form is an IRS tax form used to report various types of income other than wages, salaries, and tips. It is typically issued to independent contractors, freelancers, sole proprietors, and other self-employed individuals who receive payments of $600 or more during the tax year. There are several types of 1099 forms, each corresponding to different sources of income:

- 1099-MISC: Used to report miscellaneous income, such as payments for services performed by independent contractors.

- 1099-INT: Used to report interest income earned from investments or savings accounts.

- 1099-DIV: Used to report dividends received from investments in stocks or mutual funds.

- 1099-R: Used to report distributions from retirement accounts, such as pensions or IRAs.

Who Needs to File a 1099 Form?

Businesses and individuals who make payments to independent contractors, freelancers, or other self-employed individuals are required to issue a 1099 form if the total payments exceed $600 in a calendar year.

. Failure to do so can result in penalties from the IRS for non-compliance. On the other hand, recipients of 1099 forms are responsible for reporting this income on their tax returns and paying any applicable taxes.

Why is the 1099 Form Important?

The 1099 form is essential for tax compliance and ensures that all income earned by self-employed individuals is properly reported to the IRS. By accurately reporting income on a 1099 form, individuals can avoid potential audits, penalties, and legal consequences. Additionally, the IRS uses 1099 forms to cross-reference income reported by payers and recipients, helping to prevent tax evasion and fraud.

Case Study: The Impact of Failing to File a 1099 Form

In a recent case study, a small business owner failed to issue 1099 forms to several independent contractors who provided services throughout the year. As a result, the IRS conducted an audit and discovered the unreported income, leading to hefty fines and penalties for the business owner. This situation could have been avoided by following proper tax reporting procedures and issuing 1099 forms to all eligible recipients.

Conclusion

In conclusion, the 1099 form is a vital tool for reporting income earned by self-employed individuals and ensuring tax compliance. By understanding the purpose of the 1099 form, who needs to file it, and why it is important, individuals can navigate tax season with confidence and avoid potential pitfalls. Remember to consult with a tax professional or accountant for personalized advice on filing 1099 forms and staying compliant with IRS regulations.