-

Table of Contents

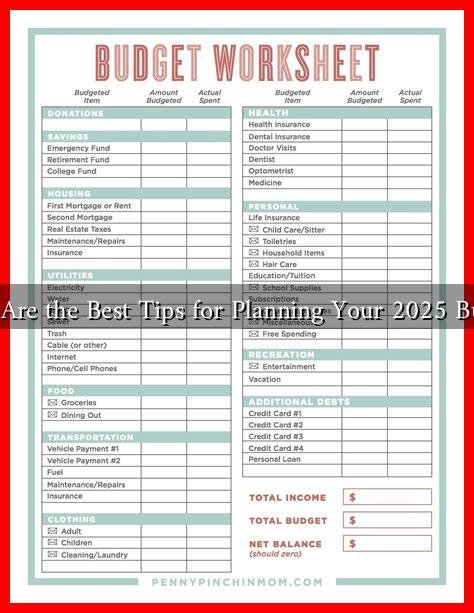

What Are the Best Tips for Planning Your 2025 Budget?

As we approach 2025, effective budgeting becomes increasingly crucial for individuals and businesses alike. A well-planned budget not only helps in managing finances but also sets the stage for achieving long-term financial goals. In this article, we will explore the best tips for planning your 2025 budget, ensuring you are well-prepared for the financial challenges and opportunities that lie ahead.

Understand Your Financial Situation

The first step in budgeting is to have a clear understanding of your current financial situation. This involves assessing your income, expenses, debts, and savings. Here are some key components to consider:

- Income: Calculate your total monthly income, including salary, bonuses, and any side hustles.

- Fixed Expenses: Identify your fixed monthly expenses such as rent, utilities, and insurance.

- Variable Expenses: Track your variable expenses, including groceries, entertainment, and dining out.

- Debt Obligations: List all debts, including credit cards, student loans, and mortgages, along with their interest rates.

- Savings: Review your current savings and investment accounts to understand your financial cushion.

By gathering this information, you can create a comprehensive picture of your financial health, which is essential for effective budgeting.

Set Clear Financial Goals

Once you have a clear understanding of your financial situation, the next step is to set specific financial goals for 2025. These goals can be short-term, medium-term, or long-term. Here are some examples:

- Short-term Goals: Save for a vacation or pay off a credit card.

- Medium-term Goals: Build an emergency fund or save for a down payment on a house.

- Long-term Goals: Plan for retirement or invest in a child’s education.

Setting clear goals will help you prioritize your spending and savings, making it easier to stick to your budget.

Choose a Budgeting Method

There are several budgeting methods available, and choosing the right one can significantly impact your financial management. Here are a few popular methods:

- The 50/30/20 Rule: Allocate 50% of your income to needs, 30% to wants, and 20% to savings and debt repayment.

- Zero-Based Budgeting: Every dollar of income is assigned a specific purpose, ensuring that your income minus expenses equals zero.

- Envelope System: Use cash for different spending categories, placing cash in envelopes to limit spending.

Choose a method that aligns with your financial goals and lifestyle. For more detailed insights on budgeting methods, you can visit NerdWallet.

Track Your Spending

Tracking your spending is crucial for staying on budget. Use budgeting apps or spreadsheets to monitor your expenses regularly. Here are some effective tools:

- Mint: A free app that helps you track expenses and manage your budget.

- YNAB (You Need A Budget): A paid app that focuses on proactive budgeting and financial education.

- Excel or Google Sheets: Create a custom spreadsheet to track your income and expenses.

Regularly reviewing your spending will help you identify areas where you can cut back and stay on track with your budget.

Review and Adjust Your Budget Regularly

Your financial situation may change throughout the year, so it’s essential to review and adjust your budget regularly. Consider the following:

- Monthly Reviews: Set aside time each month to review your budget and spending.

- Adjust for Changes: If you receive a raise or incur unexpected expenses, adjust your budget accordingly.

- Stay Flexible: Life is unpredictable; be prepared to adapt your budget as needed.

Conclusion

Planning your budget for 2025 is a proactive step towards achieving financial stability and success. By understanding your financial situation, setting clear goals, choosing the right budgeting method, tracking your spending, and regularly reviewing your budget, you can create a robust financial plan. Remember, budgeting is not just about restricting spending; it’s about making informed decisions that align with your financial aspirations. Start planning today, and set yourself up for a prosperous 2025!