-

Table of Contents

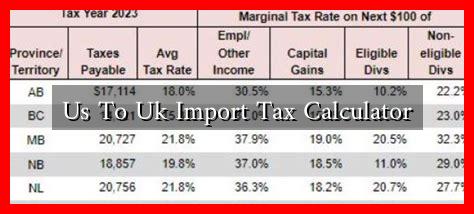

Understanding the US to UK Import Tax Calculator

When importing goods from the United States to the United Kingdom, understanding the associated taxes and duties is crucial for both businesses and individual consumers. The import tax calculator serves as a valuable tool to estimate these costs, ensuring that you are well-prepared for any financial obligations that may arise. This article will explore the intricacies of the US to UK import tax calculator, how it works, and why it is essential for anyone looking to import goods.

What is Import Tax?

Import tax, also known as customs duty, is a fee imposed by the government on goods brought into a country. In the UK, this tax is calculated based on the value of the goods, shipping costs, and insurance. The primary purpose of import tax is to protect domestic industries and generate revenue for the government.

How the US to UK Import Tax Calculator Works

The US to UK import tax calculator is a straightforward tool that helps users estimate the total import costs.

. Here’s how it typically works:

- Input Product Details: Users enter the product’s value, shipping costs, and any applicable insurance fees.

- Determine Tariff Codes: Each product has a specific tariff code that determines the applicable duty rate. Users can find these codes through the UK Trade Tariff tool.

- Calculate Duties and Taxes: The calculator applies the relevant duty rates and VAT (Value Added Tax) to provide an estimated total cost.

For example, if you are importing electronics valued at £500 with a shipping cost of £50, the calculator will help you determine the applicable duty rate based on the tariff code for electronics and calculate the VAT on the total value.

Why Use an Import Tax Calculator?

Using an import tax calculator offers several advantages:

- Budgeting: Knowing the estimated import costs helps in budgeting and financial planning.

- Avoiding Surprises: It prevents unexpected expenses at customs, which can disrupt business operations.

- Compliance: Ensures compliance with UK customs regulations, reducing the risk of penalties.

Case Study: A Small Business Importing Goods

Consider a small business owner in the UK who imports handmade jewelry from the US. By using an import tax calculator, the owner inputs the following details:

- Product Value: £1,000

- Shipping Costs: £100

- Tariff Code: 7113 (for jewelry)

After entering this information, the calculator indicates a duty rate of 5% and a VAT of 20%. The total estimated import tax would be:

- Duty: £1,000 x 5% = £50

- VAT: (£1,000 + £100 + £50) x 20% = £230

Thus, the total import cost would be £1,380, allowing the business owner to plan accordingly.

Key Considerations When Using an Import Tax Calculator

While import tax calculators are helpful, there are some key considerations to keep in mind:

- Accuracy of Information: Ensure that all product details and tariff codes are accurate to get a reliable estimate.

- Changes in Regulations: Import duties and VAT rates can change, so it’s essential to stay updated with the latest regulations.

- Additional Fees: Be aware of other potential fees, such as handling charges from shipping companies.

Conclusion

The US to UK import tax calculator is an invaluable resource for anyone looking to import goods. By providing a clear estimate of import duties and taxes, it helps individuals and businesses budget effectively and avoid unexpected costs. Understanding how to use this tool, along with being aware of the relevant regulations and potential fees, can significantly enhance the importing experience. For more detailed information on UK customs regulations, you can visit the UK Government’s official website.

In summary, whether you are a small business owner or an individual consumer, utilizing an import tax calculator can streamline the importing process and ensure compliance with UK customs regulations. By being informed and prepared, you can make the most of your importing endeavors.