-

Table of Contents

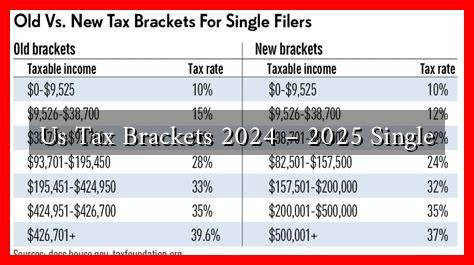

US Tax Brackets 2024 – 2025 for Singles: A Comprehensive Guide

Understanding tax brackets is crucial for effective financial planning, especially for singles navigating the complexities of the US tax system. As we approach the tax years 2024 and 2025, it’s essential to familiarize yourself with the updated tax brackets, potential changes, and how they may impact your financial situation. This article will provide a detailed overview of the tax brackets for singles, along with insights and examples to help you make informed decisions.

What Are Tax Brackets?

Tax brackets are ranges of income that are taxed at specific rates. The United States employs a progressive tax system, meaning that as your income increases, the rate at which you are taxed also increases. This system is designed to ensure that individuals with higher incomes contribute a larger share of their earnings to federal revenue.

2024 Tax Brackets for Singles

For the tax year 2024, the IRS has adjusted the tax brackets to account for inflation.

. Here are the projected tax brackets for single filers:

- 10% on income up to $11,000

- 12% on income over $11,000 to $44,725

- 22% on income over $44,725 to $95,375

- 24% on income over $95,375 to $182,100

- 32% on income over $182,100 to $231,250

- 35% on income over $231,250 to $578,125

- 37% on income over $578,125

These brackets indicate that a single filer earning $50,000 will not pay 22% on the entire amount but rather on the portion of income that falls within each bracket. For example:

- The first $11,000 is taxed at 10%.

- The income from $11,001 to $44,725 is taxed at 12%.

- The remaining income from $44,726 to $50,000 is taxed at 22%.

2025 Tax Brackets for Singles

While the IRS has not yet finalized the tax brackets for 2025, it is expected that they will continue to adjust for inflation. Based on current trends, the brackets may look similar to those of 2024, with slight increases in the income thresholds. It is advisable to stay updated through the IRS website or financial news outlets for the latest information.

Impact of Tax Brackets on Financial Planning

Understanding tax brackets is essential for effective financial planning. Here are some strategies to consider:

- Tax Deductions: Utilize available deductions to lower your taxable income. Common deductions include student loan interest, mortgage interest, and charitable contributions.

- Retirement Contributions: Contributing to retirement accounts like a 401(k) or IRA can reduce your taxable income, potentially lowering your tax bracket.

- Tax Credits: Explore available tax credits, such as the Earned Income Tax Credit (EITC) or education credits, which can directly reduce your tax liability.

Case Study: Tax Planning for a Single Filer

Consider a single filer, Sarah, who earns $60,000 in 2024. Here’s how her tax liability would be calculated:

- 10% on the first $11,000 = $1,100

- 12% on the next $33,725 ($11,001 to $44,725) = $4,047

- 22% on the remaining $15,275 ($44,726 to $60,000) = $3,360.50

In total, Sarah would owe approximately $8,507.50 in federal taxes before any deductions or credits.

Conclusion

As we look ahead to the tax years 2024 and 2025, understanding the tax brackets for singles is vital for effective financial planning. By familiarizing yourself with the current and projected tax rates, you can make informed decisions about deductions, credits, and retirement contributions. Staying proactive in your tax planning can help you minimize your tax liability and maximize your financial well-being.

For more detailed information on tax brackets and updates, visit the IRS website.