-

Table of Contents

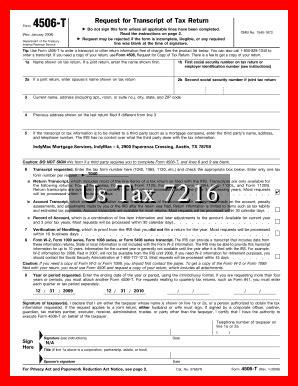

Understanding US Tax 7216: A Comprehensive Guide

In the realm of tax preparation, compliance with regulations is paramount. One such regulation that tax preparers must navigate is IRS Section 7216. This section governs the disclosure and use of taxpayer information, ensuring that sensitive data is handled with care. In this article, we will explore the intricacies of US Tax 7216, its implications for tax preparers, and the importance of compliance.

What is IRS Section 7216?

IRS Section 7216 is a provision that addresses the confidentiality of taxpayer information. It prohibits tax preparers from disclosing or using taxpayer information for any purpose other than preparing the tax return, unless the taxpayer provides explicit consent.

. This regulation is crucial for maintaining taxpayer privacy and trust in the tax preparation process.

The Importance of Compliance

Compliance with IRS Section 7216 is not just a legal obligation; it is also a matter of ethical responsibility. Tax preparers who fail to adhere to these regulations can face severe penalties, including:

- Fines up to $1,000 for each violation.

- Potential criminal charges for willful violations.

- Loss of professional licenses or certifications.

Moreover, non-compliance can lead to reputational damage, which can be detrimental to a tax preparer’s business. Clients expect their information to be handled with the utmost confidentiality, and any breach of trust can result in lost clientele and diminished credibility.

Key Provisions of Section 7216

Understanding the key provisions of Section 7216 is essential for tax preparers. Here are some critical aspects:

- Consent Requirement: Tax preparers must obtain written consent from the taxpayer before disclosing or using their information for purposes beyond tax preparation.

- Scope of Use: The information can only be used for the purpose of preparing the tax return, unless otherwise authorized by the taxpayer.

- Record Keeping: Tax preparers are required to maintain records of the consent obtained from taxpayers for a minimum of three years.

Examples of Compliance in Practice

To illustrate the importance of compliance with Section 7216, consider the following scenarios:

- Scenario 1: A tax preparer uses a client’s information to market financial products without obtaining consent. This action violates Section 7216 and could result in penalties.

- Scenario 2: A tax preparer obtains written consent from a client to share their information with a financial advisor for planning purposes. This is compliant with Section 7216, as the taxpayer has authorized the use of their information.

Best Practices for Tax Preparers

To ensure compliance with IRS Section 7216, tax preparers should adopt the following best practices:

- Educate Staff: Ensure that all employees understand the importance of confidentiality and the requirements of Section 7216.

- Implement Consent Forms: Develop clear and concise consent forms that outline how taxpayer information will be used and obtain signatures before any disclosure.

- Regular Audits: Conduct regular audits of your practices to ensure compliance with Section 7216 and other relevant regulations.

Conclusion

IRS Section 7216 plays a critical role in safeguarding taxpayer information and maintaining the integrity of the tax preparation process. By understanding the provisions of this regulation and implementing best practices, tax preparers can protect their clients’ sensitive data while avoiding potential penalties. Compliance is not just a legal requirement; it is a commitment to ethical practice and client trust. For more information on IRS regulations, you can visit the official IRS website at www.irs.gov.