-

Table of Contents

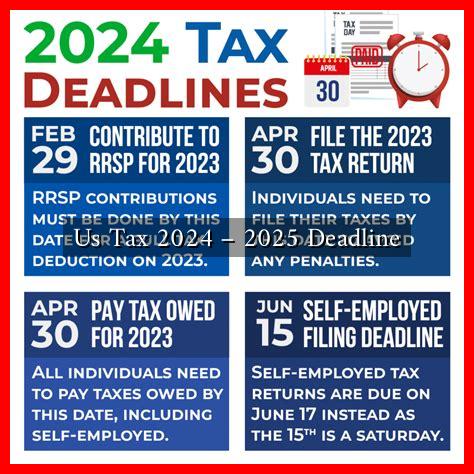

US Tax 2024 – 2025 Deadline: What You Need to Know

As the tax season approaches, understanding the deadlines and requirements for filing your taxes is crucial. The 2024-2025 tax year brings new regulations, potential changes in tax laws, and important deadlines that taxpayers must be aware of. This article will provide a comprehensive overview of the upcoming tax deadlines, key changes, and tips for a smooth filing process.

Key Tax Deadlines for 2024

The IRS has set specific deadlines for various tax-related activities. Here are the critical dates for the 2024 tax year:

- January 31, 2024: Deadline for employers to send out W-2 forms to employees and 1099 forms to independent contractors.

- April 15, 2024: Individual tax returns (Form 1040) are due. This is also the deadline for making contributions to IRAs for the 2023 tax year.

- April 15, 2024: Deadline for filing Form 4868 to request an automatic six-month extension for individual tax returns.

- June 17, 2024: Deadline for estimated tax payments for the second quarter of 2024.

- October 15, 2024: Extended deadline for individual tax returns if Form 4868 was filed.

Important Tax Changes for 2024

Tax laws can change from year to year, and 2024 is no exception.

. Here are some notable changes that may affect your tax filing:

- Standard Deduction Increase: The standard deduction for 2024 has been increased to $14,600 for single filers and $29,200 for married couples filing jointly. This change can significantly reduce taxable income.

- Child Tax Credit Adjustments: The Child Tax Credit remains at $2,000 per qualifying child, but eligibility criteria may change, impacting many families.

- Retirement Contribution Limits: The contribution limit for 401(k) plans has increased to $23,000, allowing individuals to save more for retirement.

Filing Options: Choosing the Right Method

Taxpayers have several options when it comes to filing their taxes. Understanding these options can help you choose the best method for your situation:

- Online Filing: Many taxpayers opt for e-filing due to its convenience and faster processing times. The IRS offers free e-filing options for those with simple tax situations.

- Tax Software: Various tax software programs are available that guide users through the filing process, ensuring that all deductions and credits are claimed.

- Professional Tax Preparers: For more complex tax situations, hiring a certified public accountant (CPA) or tax professional can provide valuable insights and ensure compliance with tax laws.

Common Mistakes to Avoid

Filing taxes can be daunting, and mistakes can lead to delays or penalties. Here are some common errors to watch out for:

- Incorrect Personal Information: Ensure that your name, Social Security number, and other personal details are accurate.

- Math Errors: Double-check all calculations to avoid simple arithmetic mistakes that can affect your refund or tax owed.

- Missing Deadlines: Keep track of all relevant deadlines to avoid late fees and penalties.

Conclusion: Preparing for a Successful Tax Season

As the 2024 tax season approaches, being informed about deadlines, changes in tax laws, and filing options is essential for a smooth experience. By understanding the key dates and potential changes, you can better prepare for your tax filing. Remember to avoid common mistakes and consider your filing options carefully. For more information on tax deadlines and updates, visit the IRS website.

In summary, staying organized and informed will help you navigate the complexities of the tax system, ensuring that you meet all deadlines and maximize your potential refunds. Prepare early, and you’ll find the process much less stressful.