-

Table of Contents

Understanding the United Kingdom-US Tax Treaty

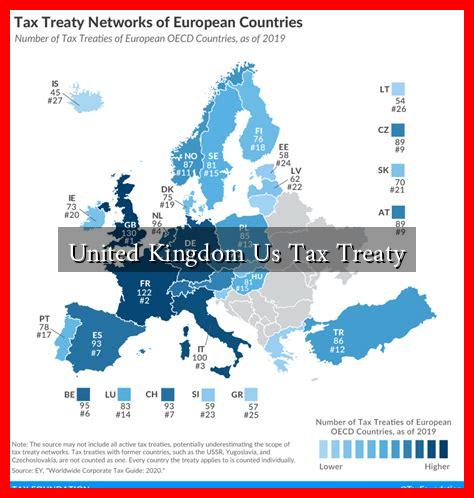

The United Kingdom and the United States have a long-standing relationship that extends beyond politics and culture; it also encompasses economic ties, particularly in taxation. The United Kingdom-US Tax Treaty, officially known as the “Convention Between the Government of the United Kingdom of Great Britain and Northern Ireland and the Government of the United States of America for the Avoidance of Double Taxation and the Prevention of Fiscal Evasion with Respect to Taxes on Income,” was established to prevent double taxation and fiscal evasion. This article delves into the key aspects of the treaty, its implications for individuals and businesses, and its significance in the global tax landscape.

What is the Purpose of the Tax Treaty?

The primary purpose of the UK-US Tax Treaty is to eliminate the risk of double taxation for individuals and businesses operating in both countries. Double taxation occurs when a taxpayer is liable to pay tax on the same income in more than one jurisdiction. The treaty aims to provide clarity and fairness in tax obligations, thereby encouraging cross-border trade and investment.

Key Provisions of the Treaty

The treaty includes several important provisions that govern how income is taxed between the two countries.

. Some of the key provisions include:

- Residency Rules: The treaty outlines how residency is determined for tax purposes, which is crucial for identifying which country has taxing rights over an individual or entity.

- Tax Rates on Dividends, Interest, and Royalties: The treaty sets reduced withholding tax rates on dividends, interest, and royalties, making it more attractive for investors. For example, the withholding tax on dividends can be reduced from 30% to 15% or even 5% in certain cases.

- Elimination of Double Taxation: The treaty provides mechanisms for taxpayers to claim relief from double taxation through foreign tax credits or exemptions.

- Exchange of Information: The treaty facilitates the exchange of information between tax authorities in both countries to combat tax evasion and ensure compliance.

Implications for Individuals and Businesses

The UK-US Tax Treaty has significant implications for both individuals and businesses engaged in cross-border activities. Here are some key points to consider:

- For Individuals: UK residents earning income in the US, such as wages or rental income, can benefit from reduced tax rates and avoid double taxation. Conversely, US citizens living in the UK can also take advantage of similar provisions.

- For Businesses: Companies operating in both jurisdictions can optimize their tax liabilities by structuring their operations in a tax-efficient manner. For instance, a UK company receiving dividends from a US subsidiary can benefit from reduced withholding tax rates.

- Investment Opportunities: The treaty encourages investment between the two countries by providing a stable tax environment, which can lead to increased economic growth and job creation.

Case Studies: Real-World Applications

To illustrate the practical implications of the UK-US Tax Treaty, consider the following case studies:

- Case Study 1: A British entrepreneur invests in a tech startup in Silicon Valley. Thanks to the treaty, the entrepreneur can repatriate profits with a reduced withholding tax rate, enhancing the overall return on investment.

- Case Study 2: An American citizen working in London can claim a foreign tax credit for taxes paid to the UK government, thereby reducing their US tax liability and avoiding double taxation.

Conclusion: The Importance of the UK-US Tax Treaty

The United Kingdom-US Tax Treaty plays a crucial role in facilitating economic relations between the two nations. By preventing double taxation and providing clear guidelines for tax obligations, the treaty fosters an environment conducive to trade and investment. As globalization continues to shape the economic landscape, understanding the intricacies of such treaties becomes increasingly important for individuals and businesses alike.

In summary, the UK-US Tax Treaty not only simplifies tax compliance but also enhances economic cooperation between the two countries. For more detailed information, you can visit the official IRS page on [Tax Treaties](https://www.irs.gov/individuals/international-taxpayers/tax-treaties).