-

Table of Contents

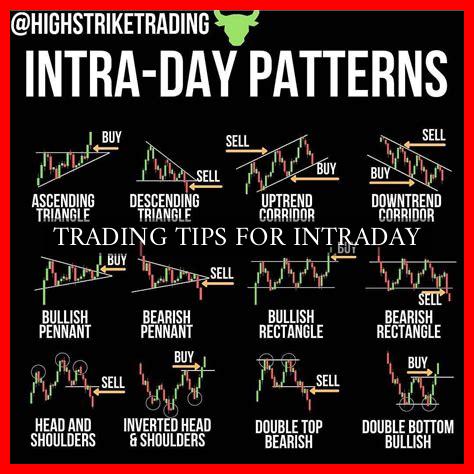

Trading Tips for Intraday

Day trading, also known as intraday trading, involves buying and selling financial instruments within the same trading day. It requires quick decision-making, a solid understanding of market trends, and the ability to manage risks effectively. In this article, we will discuss some valuable trading tips for intraday that can help you navigate the fast-paced world of day trading successfully.

1. Develop a Trading Plan

Before you start day trading, it is essential to have a well-thought-out trading plan. This plan should outline your trading goals, risk tolerance, entry and exit points, and strategies for managing trades. Having a clear plan in place can help you stay disciplined and focused during the trading day.

2. Use Technical Analysis

Technical analysis involves studying historical price data and volume to identify patterns and trends in the market. By using technical indicators such as moving averages, RSI, and MACD, you can make informed trading decisions based on market signals. It is essential to combine technical analysis with other forms of analysis to increase the accuracy of your trades.

3. Set Stop Loss Orders

One of the most crucial aspects of intraday trading is managing risk effectively. Setting stop loss orders can help you limit your losses and protect your capital. By defining your risk tolerance and setting stop loss levels before entering a trade, you can avoid emotional decision-making and minimize potential losses.

4. Monitor Market News and Events

Stay informed about market news, economic indicators, and geopolitical events that can impact the financial markets. By keeping track of relevant news and events, you can anticipate market movements and adjust your trading strategies accordingly. It is essential to be aware of both scheduled and unexpected news events that can influence market volatility.

5. Practice Proper Risk Management

Risk management is a critical aspect of successful day trading. It is essential to only risk a small percentage of your trading capital on each trade to protect yourself from significant losses. By diversifying your trades, using stop loss orders, and avoiding over-leveraging, you can minimize risks and increase your chances of long-term profitability.

6. Keep Emotions in Check

Emotions can cloud judgment and lead to impulsive trading decisions. It is crucial to keep your emotions in check and stick to your trading plan. Avoid chasing losses, overtrading, or deviating from your strategy based on fear or greed. By maintaining a disciplined approach to trading, you can improve your overall performance and consistency.

7. Review and Analyze Your Trades

After each trading day, take the time to review and analyze your trades. Identify what worked well and what could be improved in your trading strategy. By learning from your past trades and mistakes, you can refine your approach and become a more successful day trader over time.

Conclusion

Day trading can be a challenging but rewarding endeavor for those who are willing to put in the time and effort to learn and improve their skills. By following these trading tips for intraday, you can increase your chances of success in the fast-paced world of day trading. Remember to develop a solid trading plan, use technical analysis, set stop loss orders, stay informed about market news, practice proper risk management, keep emotions in check, and review and analyze your trades regularly. With dedication and discipline, you can become a successful day trader in the financial markets.