-

Table of Contents

- Understanding the Tax US Income Calculator: A Comprehensive Guide

- What is a Tax US Income Calculator?

- How Does the Tax US Income Calculator Work?

- Benefits of Using a Tax US Income Calculator

- Real-World Examples and Case Studies

- Statistics on Tax Filing and Calculator Usage

- Conclusion: The Importance of the Tax US Income Calculator

Understanding the Tax US Income Calculator: A Comprehensive Guide

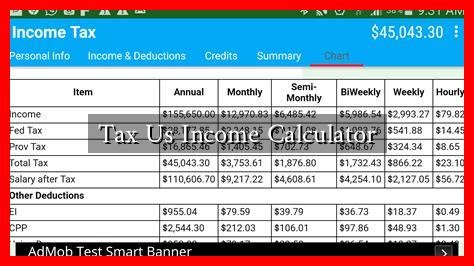

In the complex world of taxation, understanding how much you owe can be a daunting task. The Tax US Income Calculator is a valuable tool that simplifies this process, allowing individuals and businesses to estimate their tax liabilities accurately. This article delves into the functionality, benefits, and importance of using a tax income calculator, along with practical examples and insights.

What is a Tax US Income Calculator?

A Tax US Income Calculator is an online tool designed to help taxpayers estimate their federal income tax obligations based on their income, deductions, and credits. By inputting specific financial information, users can receive an estimate of their tax liability, which can aid in financial planning and budgeting.

How Does the Tax US Income Calculator Work?

The calculator typically requires users to input various data points, including:

- Filing Status: Whether you are single, married filing jointly, married filing separately, head of household, or qualifying widow(er).

- Income: Total income from all sources, including wages, self-employment income, dividends, and interest.

- Deductions: Standard or itemized deductions that can reduce taxable income.

- Tax Credits: Any applicable tax credits that can directly reduce the amount of tax owed.

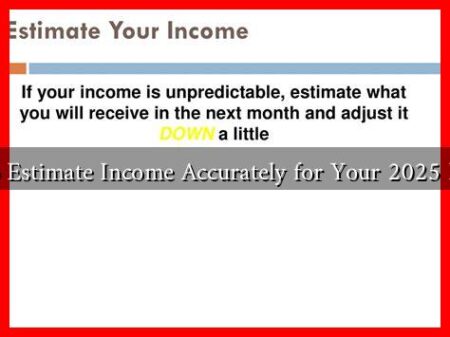

Once this information is entered, the calculator uses the current tax brackets and rates to provide an estimated tax liability. Many calculators also offer additional features, such as projections for future years based on expected income changes.

Benefits of Using a Tax US Income Calculator

Utilizing a tax income calculator offers several advantages:

- Time-Saving: Calculators provide quick estimates, saving users from lengthy manual calculations.

- Accuracy: By using up-to-date tax laws and rates, these tools can help minimize errors in tax estimations.

- Financial Planning: Understanding potential tax liabilities can assist in better financial decision-making throughout the year.

- Stress Reduction: Knowing what to expect can alleviate anxiety during tax season.

Real-World Examples and Case Studies

To illustrate the effectiveness of a Tax US Income Calculator, consider the following scenarios:

- Scenario 1: A single individual earning $50,000 annually inputs their income and standard deduction into the calculator.

. The tool estimates their federal tax liability to be approximately $6,500, allowing them to budget accordingly.

- Scenario 2: A married couple with a combined income of $120,000 uses the calculator to determine their tax obligations after accounting for mortgage interest deductions and child tax credits. The estimated tax liability comes out to $12,000, which helps them plan for their tax payments.

These examples highlight how the calculator can provide clarity and assist in financial planning.

Statistics on Tax Filing and Calculator Usage

According to the IRS, approximately 90% of taxpayers use tax preparation software or online calculators to assist with their filings. This trend underscores the growing reliance on technology to navigate the complexities of tax obligations. Furthermore, a survey by the National Association of Tax Professionals found that 70% of respondents felt more confident in their tax filings when using a calculator.

Conclusion: The Importance of the Tax US Income Calculator

In conclusion, the Tax US Income Calculator is an essential tool for anyone looking to understand their tax obligations better. By providing quick and accurate estimates, it empowers taxpayers to make informed financial decisions and reduces the stress associated with tax season. As tax laws continue to evolve, utilizing such tools will become increasingly important for effective financial planning.

For more information on tax calculators and to access a reliable tool, visit the IRS Free File page.