-

Table of Contents

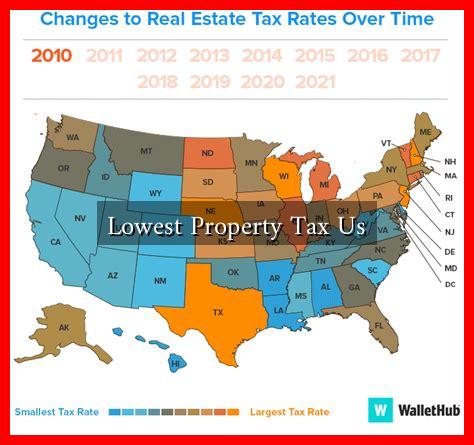

Exploring the Lowest Property Tax Rates in the U.S.

Property taxes are a significant expense for homeowners and can vary widely across the United States. Understanding where the lowest property tax rates are can help potential buyers make informed decisions about where to live. This article delves into the states with the lowest property tax rates, the factors influencing these rates, and the implications for residents.

Understanding Property Taxes

Property taxes are levied by local governments and are typically based on the assessed value of real estate. These taxes fund essential services such as education, public safety, infrastructure, and local government operations. The rate at which property is taxed can significantly impact a homeowner’s financial situation.

States with the Lowest Property Tax Rates

According to the Tax Foundation, several states consistently rank among those with the lowest property tax rates.

. Here are some of the top contenders:

- Hawaii: With an average effective property tax rate of just 0.28%, Hawaii boasts the lowest property tax rate in the nation. This is largely due to the high property values in the state, which means that even a low rate can generate significant revenue.

- Alabama: Alabama has an average effective property tax rate of 0.41%. The state’s low property values contribute to this low rate, making it an attractive option for homebuyers.

- Louisiana: Louisiana’s average effective property tax rate is 0.55%. The state offers various exemptions that can further reduce tax burdens for homeowners.

- Delaware: With an average effective rate of 0.57%, Delaware is known for its favorable tax climate, including no sales tax.

- South Carolina: South Carolina has an average effective property tax rate of 0.57%, with additional benefits for primary residences.

Factors Influencing Property Tax Rates

Several factors contribute to the variation in property tax rates across states:

- Property Values: Higher property values can lead to higher tax revenues, even with lower tax rates.

- State and Local Government Needs: Areas with greater funding needs for schools, infrastructure, and public services may impose higher property taxes.

- Exemptions and Deductions: Some states offer exemptions for certain groups, such as seniors or veterans, which can lower the effective tax rate.

- Economic Conditions: States with stronger economies may have more diverse revenue sources, allowing them to maintain lower property tax rates.

Case Studies: Low Property Tax States

To illustrate the impact of low property tax rates, let’s look at a couple of case studies:

Hawaii

Despite its low property tax rate, Hawaii has some of the highest property values in the country. The average home price in Hawaii is over $800,000, which means that even a low tax rate can result in substantial tax bills. However, the state offers various exemptions that can help mitigate costs for residents.

Alabama

In Alabama, the low property tax rate is complemented by affordable housing options. The average home price is significantly lower than the national average, making it an attractive destination for first-time homebuyers and retirees alike. The combination of low taxes and affordable housing creates a favorable environment for residents.

Implications for Homebuyers

For potential homebuyers, understanding property tax rates is crucial. Here are some implications to consider:

- Budgeting: Lower property taxes can free up funds for other expenses, such as home improvements or savings.

- Investment Potential: Areas with low property taxes may attract more buyers, potentially increasing property values over time.

- Quality of Services: It’s essential to consider how property taxes fund local services. Lower taxes may correlate with fewer resources for schools and public safety.

Conclusion

In summary, understanding the landscape of property taxes in the U.S. is vital for anyone considering purchasing a home. States like Hawaii, Alabama, and Louisiana offer some of the lowest property tax rates, but potential buyers should also consider property values, local services, and economic conditions. By weighing these factors, homebuyers can make informed decisions that align with their financial goals and lifestyle preferences.

For more information on property taxes and how they affect homeownership, visit the Tax Foundation.