-

Table of Contents

K1 US Tax Form: Understanding Its Importance and Usage

The K1 US Tax Form, officially known as Schedule K-1, is a crucial document for individuals involved in partnerships, S corporations, estates, and trusts. It serves as a means to report income, deductions, and credits from these entities to the IRS and the individual taxpayer. Understanding the K1 form is essential for accurate tax reporting and compliance. This article delves into the intricacies of the K1 form, its significance, and how to navigate its complexities.

What is the K1 Form?

The K1 form is part of the IRS Form 1065 for partnerships and Form 1120S for S corporations. It is used to report each partner’s or shareholder’s share of income, deductions, and credits.

. The K1 form is issued by the partnership or S corporation to its partners or shareholders, who then use the information to complete their individual tax returns.

Types of K1 Forms

There are three primary types of K1 forms, each corresponding to different entities:

- Schedule K-1 (Form 1065): Used for partnerships.

- Schedule K-1 (Form 1120S): Used for S corporations.

- Schedule K-1 (Form 1041): Used for estates and trusts.

Why is the K1 Form Important?

The K1 form plays a vital role in the U.S. tax system for several reasons:

- Transparency: It ensures that income from partnerships and S corporations is reported accurately, preventing tax evasion.

- Pass-Through Taxation: Income is taxed at the individual level, allowing for potential tax benefits.

- Record Keeping: It provides a clear record of income and deductions for both the entity and the individual taxpayer.

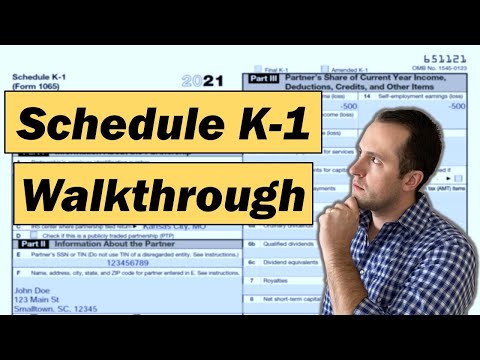

How to Read a K1 Form

Understanding how to read a K1 form is essential for accurate tax reporting. Here are the key sections of a K1 form:

- Part I: Information about the partnership or S corporation, including its name, address, and EIN (Employer Identification Number).

- Part II: Information about the partner or shareholder, including their name, address, and tax identification number.

- Part III: This section details the partner’s or shareholder’s share of income, deductions, and credits. It includes various lines for ordinary business income, rental income, and capital gains.

Common Challenges with K1 Forms

While the K1 form is essential, it can also present challenges for taxpayers:

- Timing Issues: K1 forms are often issued late, which can delay individual tax filings.

- Complexity: The information can be complicated, especially for those unfamiliar with tax laws.

- Errors: Mistakes on the K1 form can lead to discrepancies in tax returns, resulting in audits or penalties.

Case Study: The Impact of K1 Forms on Tax Returns

Consider a hypothetical scenario involving a partnership named ABC Partners. In 2022, ABC Partners generated $500,000 in income and incurred $200,000 in expenses. Each partner, John and Jane, owns a 50% share. The K1 form issued to each partner would report:

- Ordinary Business Income: $250,000 (50% of $500,000)

- Deductions: $100,000 (50% of $200,000)

John and Jane would then report this information on their individual tax returns, allowing them to benefit from pass-through taxation.

Conclusion

The K1 US Tax Form is a critical component of the tax reporting process for individuals involved in partnerships, S corporations, estates, and trusts. Understanding its structure, significance, and potential challenges can help taxpayers navigate their tax obligations more effectively. By ensuring accurate reporting and timely filing, individuals can maximize their tax benefits and maintain compliance with IRS regulations. For more detailed information on K1 forms, you can visit the IRS website.