-

Table of Contents

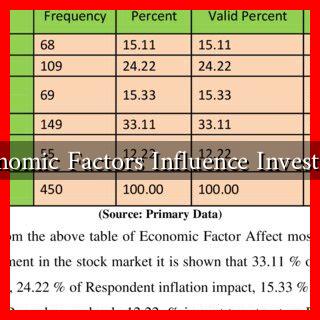

How Will Economic Factors Influence Investments in 2025

As we approach 2025, the global economic landscape is poised for significant changes that will undoubtedly influence investment strategies. Understanding these economic factors is crucial for investors looking to navigate the complexities of the market. This article explores the key economic elements that will shape investment decisions in 2025, including inflation, interest rates, technological advancements, and geopolitical dynamics.

The Inflation Factor

Inflation has been a hot topic in recent years, and its trajectory will play a pivotal role in investment strategies moving into 2025. High inflation rates can erode purchasing power and impact corporate profits, leading to volatility in the stock market. Investors must consider the following:

- Asset Allocation: In an inflationary environment, tangible assets like real estate and commodities often outperform traditional stocks and bonds.

- Inflation-Protected Securities: Instruments such as Treasury Inflation-Protected Securities (TIPS) can provide a hedge against rising prices.

- Sector Rotation: Certain sectors, like energy and consumer staples, may perform better during inflationary periods.

According to a report by the International Monetary Fund (IMF), inflation rates are expected to stabilize around 3% globally by 2025, but regional disparities will persist. Investors should remain vigilant and adjust their portfolios accordingly.

Interest Rates and Monetary Policy

Central banks play a crucial role in shaping the economic environment through their monetary policies. As we move towards 2025, interest rates are expected to fluctuate based on economic recovery and inflation control measures. Key considerations include:

- Rising Interest Rates: If central banks increase rates to combat inflation, borrowing costs will rise, potentially slowing down economic growth.

- Impact on Bonds: Higher interest rates typically lead to lower bond prices, making fixed-income investments less attractive.

- Equity Market Volatility: Increased rates can lead to market corrections, affecting stock valuations.

For instance, the Federal Reserve’s actions in 2023 to raise interest rates have already begun to influence market dynamics, and similar trends are expected to continue into 2025.

Technological Advancements and Innovation

The rapid pace of technological innovation is another critical factor influencing investments. As we approach 2025, several trends are likely to shape the investment landscape:

- Artificial Intelligence (AI): Companies leveraging AI for efficiency and innovation are expected to attract significant investment. The AI market is projected to reach $190 billion by 2025, according to a report by MarketsandMarkets.

- Green Technology: With increasing awareness of climate change, investments in renewable energy and sustainable practices are on the rise. The global green technology market is expected to grow at a CAGR of 25% through 2025.

- Healthcare Innovations: The pandemic has accelerated advancements in telemedicine and biotechnology, making healthcare a lucrative investment sector.

Investors should consider diversifying their portfolios to include companies at the forefront of these technological advancements.

Geopolitical Dynamics

Geopolitical factors can significantly impact global markets and investment strategies. As we approach 2025, several geopolitical issues warrant attention:

- Trade Relations: Ongoing trade tensions between major economies, such as the U.S. and China, can create uncertainty in global markets.

- Regulatory Changes: Changes in government policies regarding technology, trade, and environmental regulations can affect investment opportunities.

- Global Conflicts: Political instability in key regions can lead to market volatility and affect investor confidence.

Investors should stay informed about geopolitical developments and consider their potential impact on various sectors.

Conclusion

As we look ahead to 2025, economic factors such as inflation, interest rates, technological advancements, and geopolitical dynamics will play a crucial role in shaping investment strategies. By understanding these elements, investors can make informed decisions and position themselves for success in a rapidly changing economic landscape. Key takeaways include:

- Monitor inflation trends and adjust asset allocation accordingly.

- Stay informed about central bank policies and their impact on interest rates.

- Invest in sectors poised for growth due to technological advancements.

- Be aware of geopolitical developments that could influence market stability.

In conclusion, a proactive and informed approach will be essential for investors looking to thrive in the evolving economic environment of 2025.

For further insights on investment strategies, consider visiting Investopedia.