-

Table of Contents

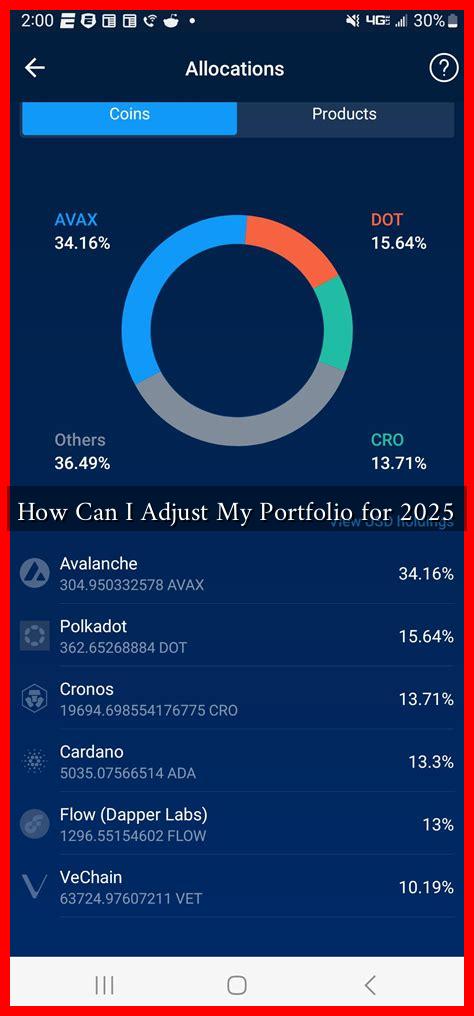

How Can I Adjust My Portfolio for 2025?

As we approach 2025, investors are faced with a rapidly changing economic landscape. Factors such as inflation, interest rates, technological advancements, and geopolitical tensions can significantly impact investment strategies. Adjusting your portfolio now can help you navigate these uncertainties and position yourself for potential growth. This article will explore key strategies for adjusting your investment portfolio for 2025.

Understanding the Current Economic Climate

Before making any adjustments, it’s crucial to understand the current economic environment. As of late 2023, several trends are shaping the market:

- Inflation Rates: Inflation has been a significant concern, with rates fluctuating around 3-4%. This can erode purchasing power and impact fixed-income investments.

- Interest Rates: Central banks are adjusting interest rates to combat inflation, which can affect borrowing costs and investment returns.

- Technological Advancements: Sectors like artificial intelligence, renewable energy, and biotechnology are experiencing rapid growth, presenting new investment opportunities.

- Geopolitical Tensions: Ongoing conflicts and trade disputes can create volatility in global markets.

Assessing Your Current Portfolio

Before making any changes, take a close look at your existing portfolio. Consider the following:

- Asset Allocation: Review the distribution of your investments across asset classes (stocks, bonds, real estate, etc.).

- Performance Analysis: Evaluate which investments have performed well and which have underperformed over the past few years.

- Risk Tolerance: Assess your risk tolerance and investment goals. Are you looking for growth, income, or a balance of both?

Strategies for Portfolio Adjustment

Once you have a clear understanding of your current portfolio, consider the following strategies to adjust it for 2025:

Diversification

Diversifying your portfolio can help mitigate risk. Consider adding exposure to different asset classes and sectors:

- International Investments: Look beyond domestic markets to emerging economies that may offer growth potential.

- Sector Rotation: Shift investments into sectors that are expected to perform well in the coming years, such as technology and renewable energy.

- Alternative Investments: Explore options like real estate investment trusts (REITs), commodities, or cryptocurrencies to enhance diversification.

Rebalancing Your Portfolio

Rebalancing involves adjusting your portfolio back to your desired asset allocation. This can help you maintain your risk profile and capitalize on market movements:

- Sell Overperforming Assets: If certain investments have grown significantly, consider selling a portion to lock in profits.

- Buy Underperforming Assets: Look for opportunities to buy undervalued assets that have the potential for recovery.

Incorporating ESG Investments

Environmental, Social, and Governance (ESG) investing is gaining traction among investors. Incorporating ESG criteria into your portfolio can align your investments with your values while potentially enhancing returns:

- Research ESG Funds: Look for mutual funds or ETFs that focus on companies with strong ESG practices.

- Evaluate Company Practices: Consider investing in companies that prioritize sustainability and ethical governance.

Staying Informed and Flexible

The investment landscape is constantly evolving. Staying informed about market trends and economic indicators is essential for making timely adjustments. Consider subscribing to financial news outlets or following market analysts on platforms like Bloomberg or Reuters.

Conclusion

Adjusting your portfolio for 2025 requires a proactive approach and a keen understanding of the economic landscape. By assessing your current investments, diversifying your portfolio, rebalancing as needed, and incorporating ESG principles, you can position yourself for success in the coming years. Remember, the key to effective investing is not just about making changes but also about staying informed and adaptable in a dynamic market.