-

Table of Contents

Understanding Foreign Income Tax in the U.S.

As globalization continues to shape the economy, many U.S. citizens and residents find themselves earning income from foreign sources. This raises important questions about how foreign income is taxed in the United States. Understanding the implications of foreign income tax is crucial for compliance and financial planning.

. This article delves into the complexities of foreign income tax in the U.S., including reporting requirements, tax treaties, and available credits.

What is Foreign Income?

Foreign income refers to any income earned outside the United States. This can include wages, dividends, interest, rental income, and capital gains. For U.S. citizens and residents, the Internal Revenue Service (IRS) requires that all worldwide income be reported, regardless of where it is earned.

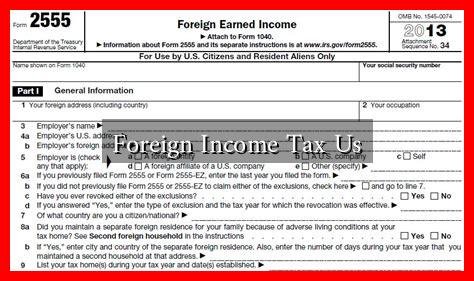

Reporting Requirements for Foreign Income

U.S. taxpayers must report foreign income on their annual tax returns. The primary forms used for this purpose include:

- Form 1040: The standard individual income tax return form.

- Schedule B: Used to report interest and ordinary dividends, including foreign accounts.

- Form 8938: Required for reporting specified foreign financial assets if the total value exceeds certain thresholds.

- FBAR (FinCEN Form 114): Required for reporting foreign bank accounts if the aggregate value exceeds $10,000 at any time during the calendar year.

Failure to report foreign income can lead to significant penalties, making it essential for taxpayers to understand their obligations.

Tax Treaties and Their Importance

The U.S. has tax treaties with many countries to prevent double taxation of income. These treaties often provide reduced tax rates or exemptions on certain types of income, such as dividends and interest. For example:

- U.S.-UK Tax Treaty: This treaty allows for reduced withholding tax rates on dividends and interest, which can benefit U.S. citizens earning income in the UK.

- U.S.-Canada Tax Treaty: Similar provisions exist, allowing for tax credits and exemptions that can reduce the overall tax burden for individuals earning income across the border.

Taxpayers should consult the IRS website or a tax professional to understand the specific provisions of the treaties that apply to their situation.

Foreign Tax Credit: Mitigating Double Taxation

To alleviate the burden of double taxation, the IRS allows U.S. taxpayers to claim a Foreign Tax Credit (FTC) for taxes paid to foreign governments. This credit can offset U.S. tax liability on foreign income, making it a valuable tool for expatriates and international earners. Key points about the FTC include:

- The credit is limited to the amount of U.S. tax attributable to foreign income.

- Taxpayers can choose between claiming the FTC or deducting foreign taxes paid as an itemized deduction.

- Form 1116 is used to calculate and claim the Foreign Tax Credit.

For example, if a U.S. citizen pays $1,000 in foreign taxes on income that is also subject to U.S. tax, they may be able to claim a credit for that amount, reducing their U.S. tax liability accordingly.

Case Study: A U.S. Expatriate in Germany

Consider the case of John, a U.S. citizen working in Germany. John earns €60,000 annually and pays €15,000 in German taxes. Under the U.S.-Germany tax treaty, he can claim a Foreign Tax Credit for the taxes paid to Germany when filing his U.S. tax return. This helps him avoid double taxation on his income, allowing him to keep more of his earnings.

Conclusion: Navigating Foreign Income Tax

Understanding foreign income tax in the U.S. is essential for anyone earning income outside the country. With the requirement to report worldwide income, the complexities of tax treaties, and the benefits of the Foreign Tax Credit, taxpayers must stay informed to ensure compliance and optimize their tax situation. Consulting with a tax professional can provide personalized guidance tailored to individual circumstances.

For more information on foreign income tax and related topics, visit the IRS International Taxpayers page.