-

Table of Contents

Understanding Florida Sales Tax

When it comes to conducting Business in Florida, understanding the state’s sales tax laws is crucial. Sales tax is a consumption tax imposed by the state on retail transactions, and it plays a significant role in generating revenue for the state government. In this article, we will delve into the intricacies of Florida sales tax, including its rates, exemptions, and compliance requirements.

Florida Sales Tax Rates

As of 2021, the state of Florida imposes a sales tax rate of 6% on most retail transactions. However, local jurisdictions such as counties and municipalities may levy additional sales Taxes on top of the state rate. This means that the total sales tax rate can vary depending on the location of the sale.

- State Sales Tax Rate: 6%

- Local Sales Tax Rate: Varies by jurisdiction

Sales Tax Exemptions

While most retail transactions are subject to sales tax in Florida, there are certain exemptions that apply to specific goods and services. Some common exemptions include:

- Food and groceries

- Prescription medications

- Medical equipment

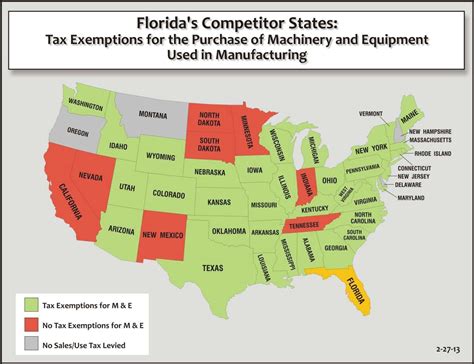

- Manufacturing machinery and equipment

It is important for businesses to be aware of these exemptions to ensure compliance with Florida sales tax laws.

Sales Tax Compliance

Businesses operating in Florida are required to collect and remit sales tax to the state. This involves registering for a sales tax permit with the Florida Department of Revenue, collecting sales tax from customers at the point of sale, and filing regular sales tax returns.

Failure to comply with Florida sales tax laws can result in penalties and fines. It is essential for businesses to maintain accurate records of sales transactions and stay up to date with their sales tax obligations.

Case Study: Online Retailer in Florida

Let’s consider a case study of an online retailer based in Florida. The retailer sells clothing and accessories to customers across the state. As an online seller, the retailer is required to collect sales tax from customers located in Florida and remit it to the state.

By registering for a sales tax permit and accurately collecting and remitting sales tax, the online retailer ensures compliance with Florida sales tax laws and avoids potential penalties.

Conclusion

Understanding Florida sales tax is essential for businesses operating in the state. By knowing the sales tax rates, exemptions, and compliance requirements, businesses can navigate the complexities of sales tax laws and avoid potential pitfalls.

For more information on Florida sales tax, visit the Florida Department of Revenue website.