-

Table of Contents

Understanding Florida 1065 Instructions

When it comes to filing Taxes in Florida, Business owners must navigate a complex set of rules and regulations. One crucial aspect of this process is understanding the Florida 1065 instructions. Form 1065 is used by partnerships to report their income, deductions, gains, losses, and other tax-related information to the Internal Revenue Service (IRS). In this article, we will delve into the details of Florida 1065 instructions, providing valuable insights for business owners and tax professionals alike.

What is Form 1065?

Form 1065, also known as the U.S. Return of Partnership Income, is used by partnerships to report their income, deductions, gains, losses, and other tax-related information to the IRS. Partnerships are not taxed at the entity level; instead, the income and losses are passed through to the individual partners, who report them on their personal tax returns.

Key Components of Florida 1065 Instructions

When filling out Form 1065 for a partnership in Florida, there are several key components to keep in mind:

- Partnership Information: This section requires basic information about the partnership, including its name, address, and Employer Identification Number (EIN).

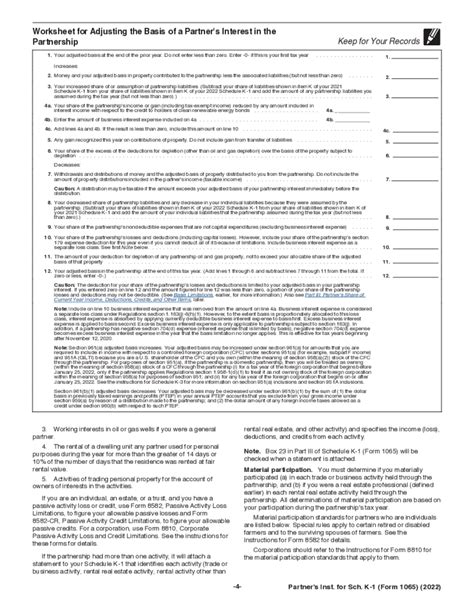

- Income and Deductions: Partnerships must report their income and deductions on Schedule K-1, which is then distributed to each partner for inclusion on their individual tax returns.

- Capital Accounts: Partnerships must maintain accurate records of each partner’s capital account, which reflects their ownership interest in the partnership.

- Tax Payments: Partnerships may be required to make estimated tax payments throughout the year to avoid penalties for underpayment.

Common Mistakes to Avoid

When filling out Form 1065, it is important to avoid common mistakes that could lead to delays or penalties. Some common errors to watch out for include:

- Incorrect Reporting: Make sure to accurately report all income, deductions, and other tax-related information on Form 1065.

- Missing Deadlines: Partnerships must file Form 1065 by the due date, which is typically March 15th for calendar year partnerships.

- Failure to Distribute Schedule K-1: Partnerships must provide each partner with a copy of Schedule K-1, which they will need to report their share of income and deductions on their personal tax returns.

Resources for Assistance

For business owners and tax professionals who need assistance with Florida 1065 instructions, there are resources available to help navigate the process. The Florida Department of Revenue offers guidance on their website, including instructional videos and FAQs. Additionally, consulting with a tax professional or accountant can provide valuable insights and ensure compliance with state and federal tax laws.

Conclusion

Understanding Florida 1065 instructions is essential for partnerships operating in the state. By following the guidelines outlined in Form 1065 and avoiding common mistakes, business owners can ensure compliance with tax laws and avoid penalties. Utilizing resources such as the Florida Department of Revenue and consulting with tax professionals can provide valuable support throughout the filing process. By staying informed and proactive, partnerships can navigate the complexities of tax filing with confidence.