-

Table of Contents

Understanding Federal Sales Tax in the United States

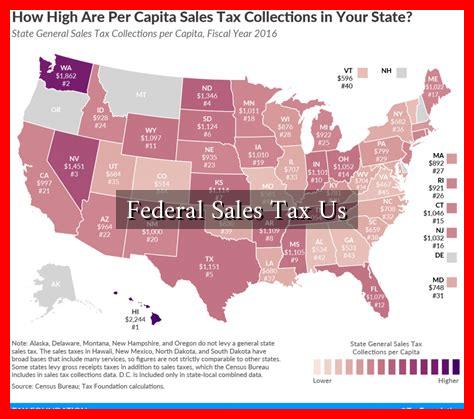

The concept of a federal sales tax in the United States has been a topic of debate for decades. While the U.S. currently relies on a combination of income taxes, payroll taxes, and state sales taxes, the idea of implementing a federal sales tax has gained traction among policymakers and economists. This article explores the implications, benefits, and challenges of a federal sales tax, providing insights into its potential impact on the economy and consumers.

What is a Federal Sales Tax?

A federal sales tax is a tax levied by the federal government on the sale of goods and services. Unlike state sales taxes, which vary by state and locality, a federal sales tax would be uniform across the country.

. The tax would typically be applied at the point of sale, meaning consumers would pay the tax when purchasing goods or services.

The Rationale Behind a Federal Sales Tax

Proponents of a federal sales tax argue that it could simplify the tax system and provide a more stable revenue source for the government. Here are some key reasons why advocates support this tax:

- Simplicity: A federal sales tax could replace the complex income tax system, making it easier for individuals and businesses to understand their tax obligations.

- Stability: Sales taxes tend to be more stable during economic downturns compared to income taxes, which can fluctuate significantly based on employment levels.

- Encouraging Savings: A sales tax does not tax income, which could encourage individuals to save and invest rather than spend.

Potential Benefits of a Federal Sales Tax

Implementing a federal sales tax could have several potential benefits:

- Increased Revenue: A federal sales tax could generate significant revenue for the government. For instance, a 5% sales tax could raise approximately $300 billion annually, based on current consumer spending levels.

- Reduction in Tax Evasion: Sales taxes are harder to evade than income taxes, as they are collected at the point of sale.

- Encouragement of Economic Growth: By reducing reliance on income taxes, a federal sales tax could stimulate economic growth by allowing individuals to keep more of their earnings.

Challenges and Criticisms

Despite the potential benefits, there are significant challenges and criticisms associated with implementing a federal sales tax:

- Regressive Nature: Sales taxes are often considered regressive, disproportionately affecting low-income individuals who spend a larger percentage of their income on consumption.

- Implementation Complexity: Transitioning to a federal sales tax system would require significant changes to the current tax infrastructure, which could be costly and complicated.

- Impact on Consumer Behavior: A federal sales tax could lead to decreased consumer spending, particularly if the tax rate is perceived as too high.

Case Studies and Examples

Several countries have successfully implemented federal sales taxes, providing valuable lessons for the U.S. For example:

- Canada: Canada has a Goods and Services Tax (GST) that is applied uniformly across the country. The GST has been credited with simplifying the tax system and providing a stable revenue source.

- Australia: Australia’s Goods and Services Tax (GST) was introduced in 2000 and has since become a significant source of revenue for the government, accounting for approximately 14% of total tax revenue.

Conclusion

The discussion surrounding a federal sales tax in the United States is complex and multifaceted. While there are compelling arguments for its implementation, including potential revenue generation and simplification of the tax system, significant challenges remain. Policymakers must carefully consider the implications of such a tax, particularly its regressive nature and impact on consumer behavior. As the debate continues, it is essential for citizens to stay informed and engaged in discussions about the future of taxation in the U.S.

For further reading on tax policy and its implications, you can visit the Tax Policy Center.