Table of ContentsUnderstanding a $60,000 After-Tax Income in the U.S.What Does $60,000 After Tax Mean?Calculating Gross IncomeCost of Living ConsiderationsBudgeting…

Browsing: USA

USA

Table of ContentsUnderstanding US Tax on $60,000: A Comprehensive GuideFederal Income Tax OverviewState Income Tax ConsiderationsDeductions and Credits: Reducing Your…

Table of ContentsUnderstanding Income Tax US 62: A Comprehensive GuideWhat is Income Tax US 62?The Components of Adjusted Gross IncomeImportance…

Table of ContentsUnderstanding Income Tax Under US Code Section 64What is IRC Section 64?The Definition of IncomeTax Implications of Income…

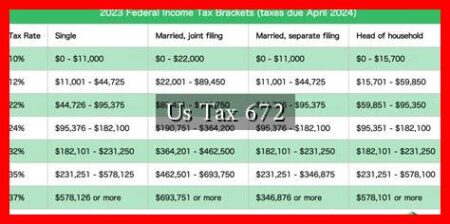

Table of ContentsUnderstanding the Tax Rate for an Income of $60,000 in the U.S.Current Federal Tax BracketsState Income TaxesDeductions and…

Table of ContentsUnderstanding Tax-Free US 64 Bonds: A Comprehensive GuideWhat Are US 64 Bonds?Types of US 64 BondsSeries I BondsSeries…

Table of ContentsUnderstanding U.S. Taxes on an Income of $66,000Tax Brackets for 2023Calculating Federal Tax LiabilityDeductions and CreditsState Taxes and…

Table of ContentsUnderstanding U.S. Taxes on a $60,000 IncomeFederal Income Tax RatesDeductions and CreditsTax Credits: A Game ChangerState Taxes and…

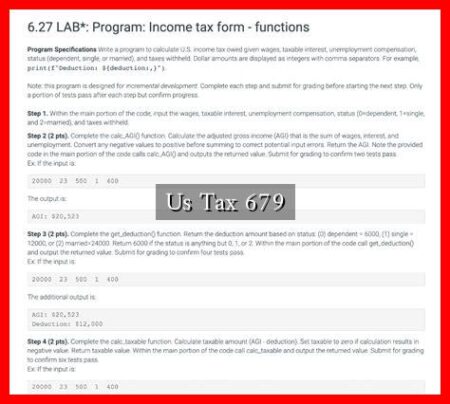

Table of ContentsUnderstanding US Tax 672: A Comprehensive GuideWhat is US Tax 672?Who Needs to File Form 672?Key Components of…

Table of ContentsUnderstanding US Tax Form 679: A Comprehensive GuideWhat is IRS Form 679?Purpose of Form 679Who Should File Form…