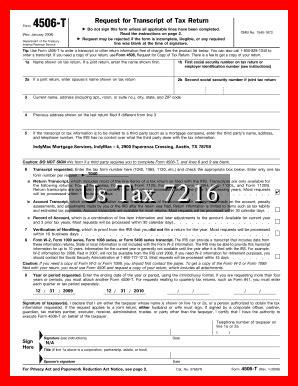

Table of ContentsUnderstanding US Tax 7216: A Comprehensive GuideWhat is IRS Section 7216?The Importance of ComplianceKey Provisions of Section 7216Examples…

Browsing: USA

USA

Table of ContentsUnderstanding US Tax Code Section 7874: Implications and InsightsWhat is Section 7874?How Corporate Inversions WorkKey Criteria Under Section…

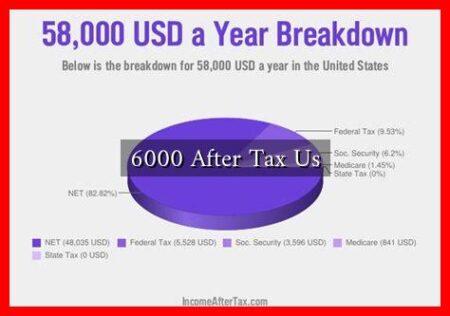

Table of ContentsUnderstanding the Implications of Earning $6,000 After Tax in the U.S.The Significance of $6,000 After TaxIncome ContextCost of…

Table of ContentsUnderstanding a $63,000 Salary After Tax in the U.S.Breaking Down the Tax ImplicationsCalculating Take-Home PayCost of Living ConsiderationsBudgeting…

Table of ContentsUnderstanding $64,000 After Tax in the U.S.The Importance of After-Tax IncomeCalculating Taxes on a $64,000 IncomeStrategies to Increase…

Table of ContentsUnderstanding $62,500 After Tax in the U.S.What Does $62,500 After Tax Mean?Calculating Gross Income Needed for $62,500 After…

Table of ContentsUnderstanding a $62,000 Salary After Tax in the U.S.Tax Breakdown for a $62,000 SalaryCost of Living ConsiderationsCase Studies:…

Table of ContentsUnderstanding the $60,000 Tax Threshold in the U.S.What Does the $60,000 Tax Threshold Represent?Income Tax Brackets and RatesThe…

Table of ContentsUnderstanding a $65,000 After Tax Income in the U.S.What Does $65,000 After Tax Mean?Calculating Gross IncomeCost of Living…

Table of ContentsUnderstanding $61,000 After Tax in the U.S.: A Comprehensive GuideBreaking Down the Tax BracketsState Taxes and Other DeductionsImpact…