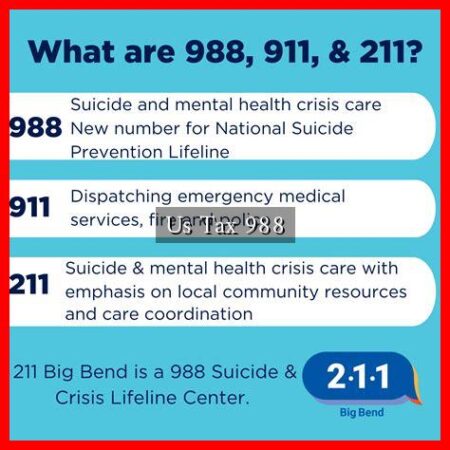

Table of ContentsUnderstanding US Tax 988: A Comprehensive GuideWhat is US Tax 988?Key Features of Section 988Examples of Section 988…

Browsing: Countries

Table of ContentsUnderstanding US Tax Form 987: A Comprehensive GuideWhat is IRS Form 987?Who Needs to File Form 987?Key Components…

Table of ContentsUnderstanding Tax Rebate US 87A: A Comprehensive GuideWhat is Tax Rebate US 87A?Eligibility Criteria for Tax Rebate US…

Table of ContentsUnderstanding $89,000 After Tax in the U.S.: A Comprehensive GuideBreaking Down the Tax BracketsState Taxes: A Variable ComponentDeductions…

Table of ContentsUnderstanding the 86000 Tax Us: A Comprehensive GuideWhat is the 86000 Tax Us Initiative?Key Objectives of the 86000…

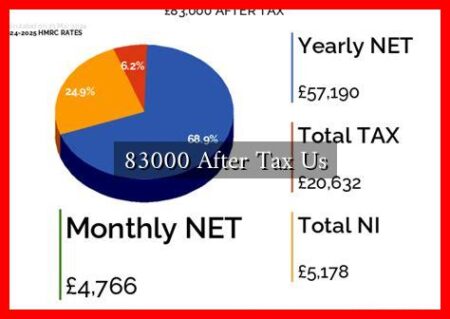

Table of ContentsUnderstanding $83,000 After Tax in the U.S.: A Comprehensive GuideBreaking Down the Tax BracketsState Taxes and Their ImpactDeductions…

Table of Contents$80,000 After Tax in the U.S.: Understanding Your Take-Home PayUnderstanding Tax BracketsCalculating Federal Taxes on $80,000State Taxes and…

Table of ContentsUnderstanding $81,000 After Tax in the U.S.: A Comprehensive GuideBreaking Down the $81,000 IncomeCalculating After-Tax IncomeImplications of After-Tax…

Table of ContentsUnderstanding $88,000 After Tax in the U.S.: A Comprehensive GuideBreaking Down the Tax BracketsCalculating Federal Taxes on $88,000State…

Table of Contents$85,000 After Tax in the U.S.: Understanding Your Take-Home PayBreaking Down the $85,000 SalaryFederal Income TaxState Income TaxOther…