-

Table of Contents

Understanding the Capital Gains Tax in the U.S.: A Comprehensive Guide to Calculators

Capital gains tax is a crucial aspect of the U.S. tax system that affects individuals and businesses alike. It is the tax levied on the profit from the sale of assets or investments, such as stocks, real estate, and other properties. Understanding how to calculate capital gains tax can be complex, but utilizing a capital gains tax calculator can simplify the process significantly. This article will explore what capital gains tax is, how it is calculated, and the benefits of using a calculator.

What is Capital Gains Tax?

Capital gains tax is imposed on the profit made from the sale of an asset.

. The gain is calculated as the difference between the selling price and the purchase price (also known as the basis). There are two types of capital gains:

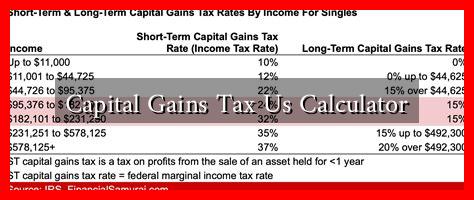

- Short-term capital gains: These are gains from assets held for one year or less and are taxed at ordinary income tax rates.

- Long-term capital gains: These are gains from assets held for more than one year and are taxed at reduced rates, typically 0%, 15%, or 20%, depending on the taxpayer’s income level.

How is Capital Gains Tax Calculated?

The calculation of capital gains tax involves several steps:

- Determine the basis: This is usually the purchase price of the asset, plus any associated costs (e.g., improvements, commissions).

- Calculate the selling price: This is the amount received from the sale of the asset.

- Calculate the gain: Subtract the basis from the selling price.

- Determine the holding period: Identify whether the gain is short-term or long-term.

- Apply the appropriate tax rate: Use the relevant tax rate based on the holding period and the taxpayer’s income level.

For example, if you bought a stock for $1,000 and sold it for $1,500 after two years, your capital gain would be $500. If your income places you in the 15% long-term capital gains tax bracket, you would owe $75 in taxes on that gain.

The Role of Capital Gains Tax Calculators

Capital gains tax calculators are valuable tools that can help taxpayers estimate their potential tax liability. These calculators take into account various factors, including:

- Purchase price and selling price of the asset

- Holding period of the asset

- Applicable tax rates based on income

- State-specific tax considerations

Using a capital gains tax calculator can save time and reduce errors in tax calculations. Many online calculators are available, such as those provided by the IRS or financial websites like Bankrate.

Case Study: Real Estate Investments

Consider a scenario where an individual purchases a rental property for $300,000 and sells it five years later for $450,000. The individual made $50,000 in improvements to the property, which can be added to the basis. The calculation would be as follows:

- Basis: $300,000 (purchase price) + $50,000 (improvements) = $350,000

- Selling Price: $450,000

- Capital Gain: $450,000 – $350,000 = $100,000

Assuming the individual falls into the 15% long-term capital gains tax bracket, the tax owed would be $15,000. A capital gains tax calculator would help confirm this calculation and provide insights into potential tax-saving strategies.

Conclusion

Understanding capital gains tax is essential for anyone involved in buying or selling assets. Utilizing a capital gains tax calculator can streamline the process, ensuring accurate calculations and helping taxpayers plan their finances effectively. By grasping the nuances of capital gains tax, individuals can make informed decisions that optimize their tax liabilities and enhance their investment strategies.

In summary, whether you are a seasoned investor or a first-time seller, being aware of how capital gains tax works and leveraging tools like calculators can lead to better financial outcomes. Always consider consulting with a tax professional for personalized advice tailored to your specific situation.