-

Table of Contents

- Born 1959 Full Retirement Age: What You Need to Know

- Understanding Full Retirement Age

- Factors to Consider

- Case Study: John and Mary

- Statistics and Trends

- Conclusion

Born 1959 Full Retirement Age: What You Need to Know

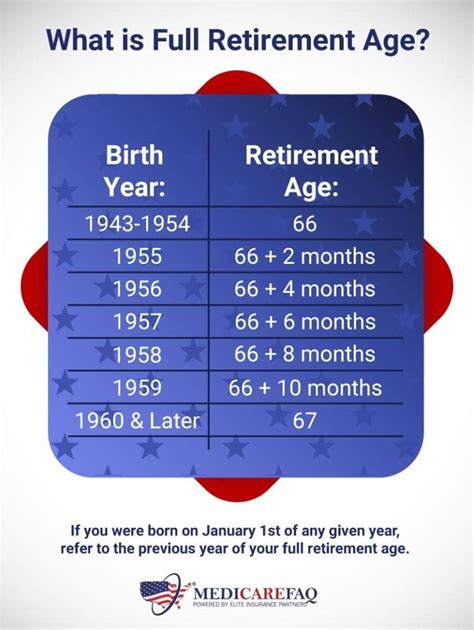

As individuals born in 1959 approach retirement age, it is essential to understand the implications of their birth year on their full retirement age. The full retirement age is the age at which individuals can receive their full Social Security benefits without any reductions. For those born in 1959, there are specific considerations and factors to keep in mind when planning for retirement.

Understanding Full Retirement Age

The full retirement age for individuals born in 1959 is 66 and 10 months. This means that individuals born in 1959 will need to wait until they reach this age to receive their full Social Security benefits. While individuals can choose to stArt receiving benefits as early as age 62, doing so will result in a reduction in their monthly benefits. On the other hand, delaying benefits past full retirement age can result in an increase in monthly benefits.

Factors to Consider

- Health and Longevity: When deciding when to start receiving Social Security benefits, individuals should consider their health and life expectancy. If you expect to live a long and healthy life, delaying benefits may be beneficial as it can result in higher monthly payments over the long term.

- Financial Situation: Individuals should also assess their financial situation and determine if they can afford to delay benefits. For some, starting benefits early may be necessary to cover living expenses, while others may have the flexibility to wait until full retirement age or even later.

- Spousal Benefits: Married individuals should consider spousal benefits when making decisions about when to start receiving Social Security. Spousal benefits can be complex, and it is important to understand how they may impact overall retirement income.

Case Study: John and Mary

Let’s consider a hypothetical example of John and Mary, both born in 1959. John plans to retire at age 66 and 10 months to receive his full Social Security benefits, while Mary plans to continue working until age 70 to maximize her benefits. By taking different approaches, John and Mary can optimize their Social Security income based on their individual circumstances.

Statistics and Trends

According to the Social Security Administration, approximately 33% of individuals choose to start receiving benefits at age 62, the earliest possible age. However, only 4% of individuals wait until age 70 to maximize their benefits. Understanding these trends can help individuals make informed decisions about when to start receiving Social Security benefits.

Conclusion

As individuals born in 1959 approach full retirement age, it is crucial to consider various factors such as health, finances, and spousal benefits when making decisions about when to start receiving Social Security benefits. By understanding the implications of their birth year on their full retirement age, individuals can make informed choices that align with their retirement goals and financial needs.

For more information on Social Security benefits and retirement planning, visit the Social Security Administration website.