-

Table of Contents

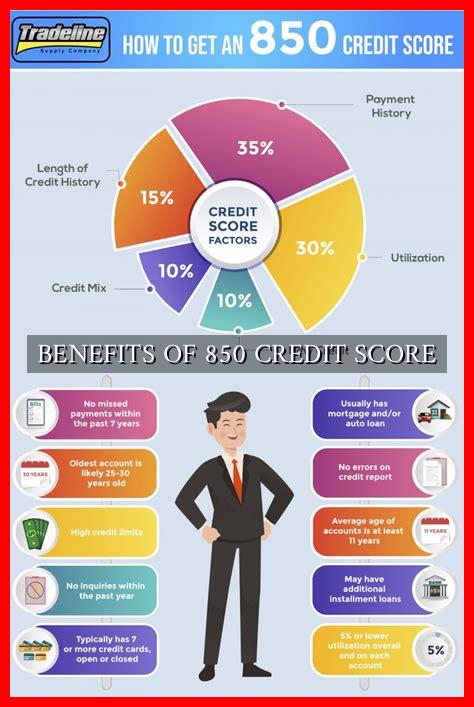

The Benefits of an 850 Credit Score

Having a high credit score is essential for financial success and stability. Among the various credit scores available, an 850 credit score is considered the pinnacle of creditworthiness. Achieving this score can open up a world of opportunities and benefits for individuals. In this article, we will explore the advantages of having an 850 credit score and how it can positively impact your financial life.

What is an 850 Credit Score?

An 850 credit score is the highest possible score on the FICO credit scoring model, which ranges from 300 to 850. This score indicates to lenders that you are extremely low risk and highly likely to repay any debts on time. Achieving an 850 credit score requires a history of responsible credit management, including on-time payments, low credit utilization, and a mix of different types of credit accounts.

Benefits of an 850 Credit Score

1. Access to the Best Interest Rates

With an 850 credit score, you are likely to qualify for the lowest interest rates on loans and credit cards. Lenders view individuals with high credit scores as less risky, so they offer them the most favorable terms. This can save you thousands of dollars in interest payments over the life of a loan.

2. Higher Credit Limits

Lenders are more willing to extend higher credit limits to individuals with excellent credit scores. This can provide you with greater purchasing power and flexibility in managing your finances. With a high credit limit, you can take advantage of rewards programs and cashback offers without worrying about maxing out your credit cards.

3. Approval for Premium Credit Cards

Many premium credit cards with exclusive benefits and rewards require an excellent credit score for approval. With an 850 credit score, you can qualify for these prestigious cards, which offer perks such as travel rewards, concierge services, and luxury hotel stays. These cards can enhance your lifestyle and provide valuable benefits.

4. Easier Approval for Loans and Mortgages

When applying for a mortgage or a personal loan, having an 850 credit score can make the approval process smoother and faster. Lenders are more likely to approve your application and offer you competitive terms, making it easier to achieve your financial goals, such as buying a home or starting a business.

5. Lower Insurance Premiums

Some insurance companies use credit scores to determine premiums for auto and home insurance. With an 850 credit score, you may qualify for lower insurance rates, saving you money on monthly premiums. Maintaining a high credit score can lead to significant savings over time.

Conclusion

Having an 850 credit score comes with a multitude of benefits that can positively impact your financial well-being. From access to the best interest rates and premium credit cards to easier approval for loans and lower insurance premiums, a high credit score opens doors to financial opportunities. By maintaining responsible credit habits and striving for an 850 credit score, you can enjoy these advantages and secure a brighter financial future.

For more information on how to improve your credit score, check out this resource.