-

Table of Contents

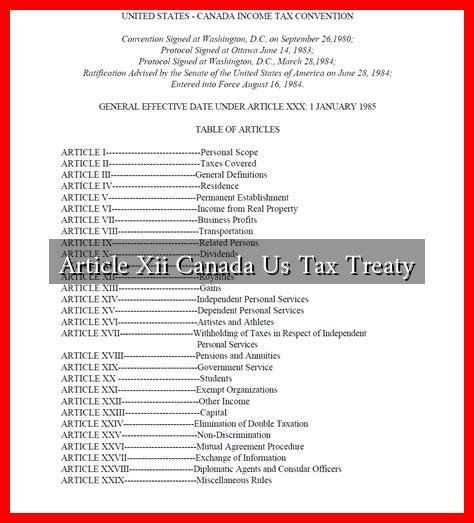

Understanding Article XII of the Canada-US Tax Treaty

The Canada-US Tax Treaty, officially known as the Convention Between Canada and the United States of America with Respect to Taxes on Income and on Capital, was established to prevent double taxation and fiscal evasion. Among its various provisions, Article XII plays a crucial role in addressing the taxation of royalties. This article delves into the specifics of Article XII, its implications for taxpayers, and its significance in cross-border transactions.

What is Article XII?

Article XII of the Canada-US Tax Treaty specifically deals with the taxation of royalties. Royalties are payments made for the use of intellectual property, such as patents, copyrights, trademarks, and other forms of intangible assets. The treaty aims to clarify how these payments are taxed in both countries to avoid double taxation and ensure fair treatment for taxpayers.

Key Provisions of Article XII

Article XII outlines several important provisions regarding the taxation of royalties:

- Definition of Royalties: The article defines royalties broadly to include payments for the use of or the right to use intellectual property.

- Tax Rates: The treaty stipulates reduced withholding tax rates on royalties paid from one country to residents of the other.

. For instance, the withholding tax rate on royalties is generally limited to 10%.

- Exemptions: Certain types of royalties may be exempt from taxation under specific conditions, such as payments for the use of industrial, commercial, or scientific equipment.

Implications for Taxpayers

The provisions of Article XII have significant implications for individuals and businesses engaged in cross-border transactions between Canada and the United States. Here are some key points to consider:

- Reduced Tax Burden: By limiting withholding tax rates, Article XII helps reduce the overall tax burden on royalties, making it more attractive for businesses to engage in cross-border licensing agreements.

- Compliance Requirements: Taxpayers must ensure compliance with both Canadian and US tax laws, including filing the necessary forms to claim reduced withholding rates.

- Impact on Business Decisions: Understanding the tax implications of royalties can influence business decisions, such as whether to license intellectual property or enter into joint ventures.

Case Studies: Real-World Applications

To illustrate the practical implications of Article XII, consider the following case studies:

- Case Study 1: A Canadian Software Company – A Canadian software company licenses its technology to a US-based firm. Under Article XII, the US firm pays royalties subject to a reduced withholding tax rate of 10%, rather than the standard rate of 30%. This reduction enhances the profitability of the licensing agreement.

- Case Study 2: A US Music Publisher – A US music publisher receives royalties from a Canadian artist for the use of copyrighted music. By applying Article XII, the publisher benefits from a lower withholding tax rate, allowing for greater revenue retention and reinvestment into new projects.

Statistics and Trends

According to the Canada Revenue Agency (CRA), cross-border royalty payments have seen a significant increase over the past decade, reflecting the growing importance of intellectual property in the global economy. In 2022 alone, the total royalty payments between Canada and the US exceeded $5 billion, highlighting the relevance of Article XII in facilitating these transactions.

Conclusion

Article XII of the Canada-US Tax Treaty serves as a vital framework for the taxation of royalties, providing clarity and reducing the tax burden for businesses engaged in cross-border transactions. By understanding its provisions, taxpayers can make informed decisions that enhance their financial outcomes. As the global economy continues to evolve, the importance of such treaties in fostering international trade and investment cannot be overstated.

For more detailed information on the Canada-US Tax Treaty, you can visit the official [Canada Revenue Agency website](https://www.canada.ca/en/revenue-agency.html).