-

Table of Contents

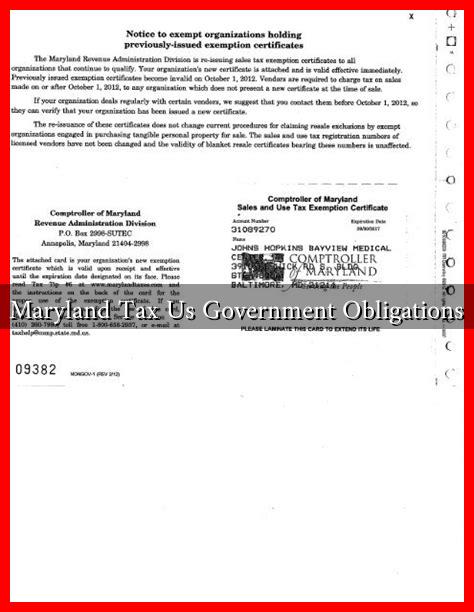

- Maryland Tax on U.S. Government Obligations: An In-Depth Analysis

- What Are U.S. Government Obligations?

- Taxation of U.S. Government Obligations in Maryland

- Why Does Maryland Exempt U.S. Government Obligations from State Tax?

- Case Studies: Impact on Maryland Residents

- Statistics on Investment in U.S.

. Government Obligations

- Conclusion

Maryland Tax on U.S. Government Obligations: An In-Depth Analysis

Understanding the tax implications of U.S. government obligations in Maryland is crucial for investors, financial planners, and taxpayers alike. This article delves into the specifics of how Maryland taxes these obligations, the rationale behind these tax policies, and the implications for residents and investors.

What Are U.S. Government Obligations?

U.S. government obligations refer to debt securities issued by the federal government, including Treasury bills, notes, and bonds. These instruments are considered low-risk investments, as they are backed by the full faith and credit of the U.S. government. Investors often turn to these securities for their stability and predictable returns.

Taxation of U.S. Government Obligations in Maryland

In Maryland, the taxation of U.S. government obligations is a nuanced topic. While the federal government does not tax its own obligations, states have the authority to impose taxes on the interest earned from these securities. Here’s how Maryland approaches this issue:

- Exemption from State Income Tax: Maryland residents are not required to pay state income tax on interest earned from U.S. Treasury securities. This exemption makes these investments particularly attractive for Maryland taxpayers.

- Local Tax Considerations: While the state does not tax these obligations, local jurisdictions may have their own tax policies. It is essential for investors to check local regulations to understand any potential tax liabilities.

- Comparison with Other States: Many states follow a similar approach, exempting U.S. government obligations from state income tax. However, some states may tax interest from other types of government bonds, such as municipal bonds.

Why Does Maryland Exempt U.S. Government Obligations from State Tax?

The rationale behind Maryland’s tax exemption for U.S. government obligations is multifaceted:

- Encouraging Investment: By exempting these securities from state income tax, Maryland aims to encourage residents to invest in low-risk government securities, thereby promoting financial stability.

- Attracting Wealthy Residents: The tax exemption can be seen as a strategy to attract high-net-worth individuals who may be more inclined to invest in government securities if they are not subject to state taxes.

- Alignment with Federal Policy: The exemption aligns Maryland’s tax policy with federal guidelines, reinforcing the notion that government obligations are a safe investment.

Case Studies: Impact on Maryland Residents

To illustrate the impact of this tax policy, consider the following hypothetical scenarios:

- Scenario 1: A Maryland resident invests $100,000 in U.S. Treasury bonds with an interest rate of 2%. Over a year, they earn $2,000 in interest. Because of the state tax exemption, they retain the full $2,000, enhancing their overall return.

- Scenario 2: In contrast, if the same resident invested in a corporate bond yielding 3% that is subject to state income tax, they would face a tax liability that could significantly reduce their net earnings.

Statistics on Investment in U.S. Government Obligations

According to the U.S. Department of the Treasury, as of 2023, approximately 30% of individual investors hold U.S. government securities in their portfolios. In Maryland, this percentage is likely higher due to the favorable tax treatment. Additionally, a survey by the Investment Company Institute found that:

- Over 50% of Maryland residents consider tax implications when choosing investment vehicles.

- Investors in Maryland are more likely to invest in U.S. Treasury securities compared to other states, primarily due to the tax exemption.

Conclusion

Maryland’s tax policy regarding U.S. government obligations presents a unique opportunity for residents and investors. By exempting interest earned from these securities from state income tax, Maryland not only encourages investment in low-risk assets but also aligns its policies with federal guidelines. As a result, Maryland residents can enjoy the benefits of investing in U.S. government obligations without the burden of state taxation. Understanding these nuances is essential for making informed investment decisions and maximizing returns.

For more information on Maryland’s tax policies, you can visit the Maryland State Comptroller’s website.