-

Table of Contents

Understanding US Tax Knowledge: A Comprehensive Guide

Taxation is a fundamental aspect of American life, influencing everything from personal finances to business operations. Understanding the intricacies of the US tax system is crucial for individuals and businesses alike. This article aims to provide a comprehensive overview of US tax knowledge, covering essential concepts, common pitfalls, and practical tips for effective tax management.

The Basics of the US Tax System

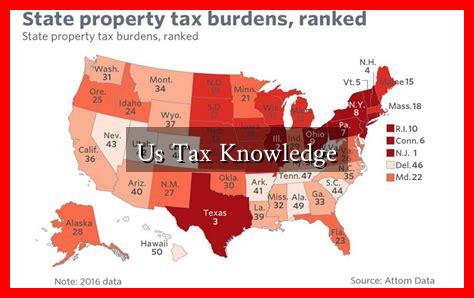

The US tax system is primarily governed by the Internal Revenue Service (IRS), which administers federal tax laws. Taxes are collected at various levels, including federal, state, and local governments. Here are some key components of the US tax system:

- Types of Taxes: The main types of taxes include income tax, payroll tax, corporate tax, capital gains tax, and estate tax.

- Tax Brackets: The federal income tax system is progressive, meaning that tax rates increase as income rises.

. For example, as of 2023, the tax rates range from 10% to 37% based on income levels.

- Filing Status: Taxpayers must choose a filing status (e.g., single, married filing jointly, head of household) that affects their tax rates and deductions.

Common Tax Deductions and Credits

Understanding available deductions and credits can significantly reduce tax liability. Here are some common deductions and credits that taxpayers should be aware of:

- Standard Deduction: For the tax year 2023, the standard deduction is $13,850 for single filers and $27,700 for married couples filing jointly.

- Itemized Deductions: Taxpayers can choose to itemize deductions for expenses such as mortgage interest, state and local taxes, and charitable contributions.

- Tax Credits: Unlike deductions, which reduce taxable income, tax credits directly reduce the amount of tax owed. Examples include the Earned Income Tax Credit (EITC) and the Child Tax Credit.

Common Pitfalls in Tax Filing

Many taxpayers make mistakes that can lead to penalties or missed opportunities for savings. Here are some common pitfalls to avoid:

- Filing Late: Failing to file taxes on time can result in penalties and interest. It’s essential to file by the deadline, typically April 15th.

- Incorrect Information: Errors in Social Security numbers, income reporting, or deductions can trigger audits or delays in refunds.

- Neglecting State Taxes: Many taxpayers focus solely on federal taxes, but state taxes can also significantly impact overall tax liability.

Case Study: The Impact of Tax Knowledge on Small Businesses

Consider a small business owner, Jane, who runs a local bakery. Jane initially filed her taxes without understanding the various deductions available to her business. After consulting with a tax professional, she learned about:

- Deducting the cost of ingredients and supplies.

- Claiming home office deductions since she manages her business from home.

- Utilizing the Qualified Business Income deduction, which allows eligible businesses to deduct up to 20% of their qualified business income.

As a result, Jane was able to reduce her taxable income significantly, leading to substantial tax savings. This case illustrates the importance of tax knowledge for maximizing deductions and credits.

Resources for Further Learning

For those looking to deepen their understanding of US tax laws, several resources are available:

- IRS Official Website: The primary source for tax information, forms, and guidelines.

- NerdWallet Tax Deductions Guide: A comprehensive guide to various tax deductions available to individuals and businesses.

- Tax Policy Center: Offers research and analysis on tax policy issues.

Conclusion

Understanding US tax knowledge is essential for effective financial management. By familiarizing oneself with the basics of the tax system, recognizing available deductions and credits, and avoiding common pitfalls, taxpayers can optimize their tax situations. As demonstrated through Jane’s case study, informed tax decisions can lead to significant savings. For anyone navigating the complexities of the US tax system, continuous learning and seeking professional advice can make a substantial difference in achieving financial goals.