-

Table of Contents

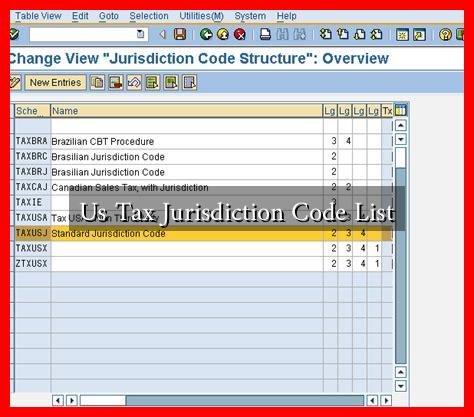

Understanding the US Tax Jurisdiction Code List

The United States tax system is complex, with various codes and regulations governing how taxes are assessed, collected, and enforced. One critical aspect of this system is the US Tax Jurisdiction Code List, which categorizes different tax jurisdictions and their respective codes. This article aims to provide a comprehensive overview of the US Tax Jurisdiction Code List, its significance, and how it impacts taxpayers and tax professionals alike.

What is the US Tax Jurisdiction Code List?

The US Tax Jurisdiction Code List is a compilation of codes that define the various tax jurisdictions within the United States. These codes are essential for identifying the specific tax rules and regulations that apply to different regions, including states, counties, and municipalities. The list is maintained by the Internal Revenue Service (IRS) and is crucial for ensuring compliance with federal, state, and local tax laws.

Importance of Tax Jurisdiction Codes

Tax jurisdiction codes play a vital role in the administration of taxes in the US.

. Here are some key reasons why they are important:

- Compliance: Taxpayers must understand which jurisdiction they fall under to comply with the relevant tax laws.

- Accurate Tax Reporting: Businesses and individuals need to report their income and expenses accurately based on their jurisdiction.

- Tax Planning: Understanding jurisdiction codes can help taxpayers strategize their tax planning to minimize liabilities.

- Audit Preparedness: Knowledge of jurisdiction codes can aid in preparing for potential audits by ensuring all tax obligations are met.

Categories of Tax Jurisdiction Codes

The US Tax Jurisdiction Code List is divided into several categories, each representing different levels of government. These include:

- Federal Jurisdictions: These codes apply to federal taxes, such as income tax and payroll tax.

- State Jurisdictions: Each state has its own set of codes that govern state income tax, sales tax, and other state-specific taxes.

- Local Jurisdictions: Counties and municipalities may impose additional taxes, and their codes are included in the jurisdiction list.

Examples of Tax Jurisdiction Codes

To illustrate how tax jurisdiction codes work, consider the following examples:

- California (CA): The state has a unique tax code that governs income tax rates, sales tax, and property tax.

- New York City (NYC): NYC has its own tax codes that apply in addition to New York State taxes, including a local income tax.

- Cook County (IL): This county has specific codes for property taxes and local sales taxes that differ from the state level.

Case Studies: The Impact of Tax Jurisdiction Codes

Understanding tax jurisdiction codes can significantly impact taxpayers. For instance, a business operating in multiple states must navigate various tax codes to ensure compliance. A case study involving a tech company that expanded from California to Texas illustrates this point:

The company initially faced challenges in understanding the different tax obligations in California, which has a higher corporate tax rate, compared to Texas, which has no state income tax. By consulting the US Tax Jurisdiction Code List, the company was able to adjust its tax strategy, resulting in substantial savings and improved cash flow.

Resources for Tax Professionals

Tax professionals can benefit from various resources to stay updated on jurisdiction codes. Some valuable resources include:

- IRS Official Website: The IRS provides comprehensive information on tax codes and jurisdiction.

- Tax Foundation: This organization offers research and analysis on tax policies across the US.

- National Association of State Boards of Accountancy (NASBA): A resource for accounting professionals to understand state-specific regulations.

Conclusion

The US Tax Jurisdiction Code List is an essential tool for taxpayers and tax professionals alike. Understanding these codes is crucial for compliance, accurate reporting, and effective tax planning. As the tax landscape continues to evolve, staying informed about jurisdiction codes will help individuals and businesses navigate the complexities of the US tax system. By leveraging available resources and case studies, taxpayers can make informed decisions that optimize their tax obligations and enhance their financial well-being.