-

Table of Contents

US Tax Guide: Navigating the Complexities of the American Tax System

Understanding the intricacies of the US tax system can be daunting for many individuals and businesses. With various tax laws, regulations, and deadlines, it is essential to have a comprehensive guide to navigate this complex landscape. This article aims to provide valuable insights into the US tax system, including key concepts, filing requirements, and tips for maximizing deductions.

Understanding the Basics of US Taxes

The US tax system is primarily based on a progressive income tax structure, meaning that individuals and businesses are taxed at different rates depending on their income levels. Here are some fundamental concepts to grasp:

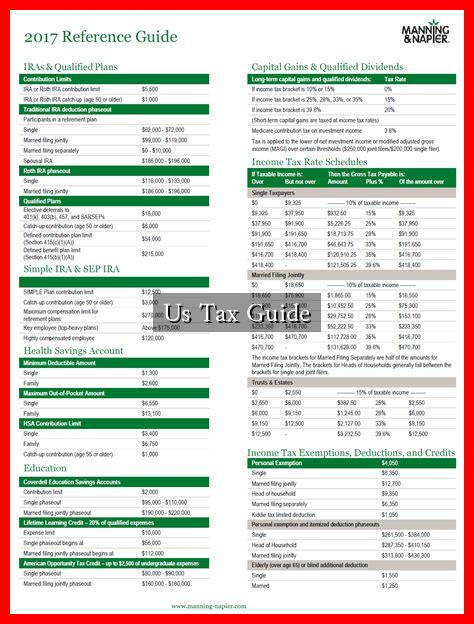

- Tax Brackets: The IRS divides income into brackets, each taxed at a different rate. For example, as of 2023, the federal income tax rates range from 10% to 37% based on income levels.

- Filing Status: Your filing status (e.g., single, married filing jointly, head of household) affects your tax rate and the deductions you can claim.

- Tax Deductions and Credits: Deductions reduce your taxable income, while credits reduce your tax liability directly.

. Understanding the difference is crucial for effective tax planning.

Filing Requirements and Deadlines

Filing your taxes accurately and on time is essential to avoid penalties. Here are the key deadlines and requirements:

- Filing Deadline: The standard deadline for filing individual tax returns is April 15. If this date falls on a weekend or holiday, the deadline is extended to the next business day.

- Extensions: Taxpayers can file for an extension, which gives them until October 15 to submit their returns. However, any taxes owed must still be paid by the original deadline to avoid interest and penalties.

- Income Thresholds: Individuals must file a tax return if their income exceeds certain thresholds, which vary based on filing status and age. For example, in 2023, a single filer under 65 must file if their gross income is at least $13,850.

Maximizing Deductions and Credits

To minimize your tax liability, it is crucial to take advantage of available deductions and credits. Here are some common options:

- Standard Deduction: For the tax year 2023, the standard deduction is $13,850 for single filers and $27,700 for married couples filing jointly. This deduction reduces your taxable income.

- Itemized Deductions: If your eligible expenses exceed the standard deduction, you may benefit from itemizing deductions, which can include mortgage interest, state and local taxes, and charitable contributions.

- Tax Credits: Some popular tax credits include the Earned Income Tax Credit (EITC), Child Tax Credit, and education credits. These credits can significantly reduce your tax bill.

Common Mistakes to Avoid

Filing taxes can be complicated, and mistakes can lead to audits or penalties. Here are some common pitfalls to avoid:

- Incorrect Information: Ensure that all personal information, including Social Security numbers and income figures, is accurate.

- Missing Deadlines: Keep track of all deadlines to avoid late fees and penalties.

- Neglecting State Taxes: Many states have their own tax laws and filing requirements. Be sure to understand your state’s tax obligations.

Conclusion: Navigating Your Tax Journey

Understanding the US tax system is essential for individuals and businesses alike. By familiarizing yourself with tax brackets, filing requirements, and available deductions and credits, you can effectively manage your tax obligations and potentially save money. Remember to keep accurate records, stay informed about changes in tax laws, and consider consulting a tax professional for personalized advice.

For more detailed information on US taxes, you can visit the IRS website, which offers a wealth of resources and tools to assist taxpayers.

In summary, being proactive and informed about your tax situation can lead to better financial outcomes and peace of mind during tax season.