-

Table of Contents

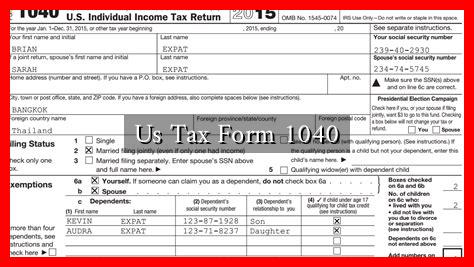

Understanding the US Tax Form 1040: A Comprehensive Guide

The US Tax Form 1040 is a crucial document for millions of American taxpayers. It serves as the primary form used to file individual income tax returns with the Internal Revenue Service (IRS). Understanding this form is essential for ensuring compliance with tax laws and maximizing potential refunds. This article will delve into the details of Form 1040, its significance, and how to navigate it effectively.

What is Form 1040?

Form 1040, officially known as the “U.S. Individual Income Tax Return,” is the standard federal income tax form used by individuals to report their income, claim deductions, and calculate their tax liability.

. The form has undergone several revisions over the years, with the most recent version being introduced in 2018, which simplified the filing process for many taxpayers.

Why is Form 1040 Important?

Filing Form 1040 is not just a legal obligation; it also plays a significant role in the financial health of individuals and the economy as a whole. Here are some reasons why it is important:

- Legal Compliance: Filing taxes is a legal requirement for most individuals earning above a certain income threshold.

- Tax Refunds: Many taxpayers are eligible for refunds, which can provide a financial boost.

- Access to Benefits: Filing taxes can make individuals eligible for various government benefits and credits, such as the Earned Income Tax Credit (EITC).

- Financial Planning: Understanding tax obligations can aid in better financial planning and investment strategies.

Key Components of Form 1040

Form 1040 consists of several sections that taxpayers must complete. Here are the key components:

- Personal Information: This section requires basic information such as name, address, and Social Security number.

- Filing Status: Taxpayers must select their filing status, which can affect tax rates and eligibility for certain credits.

- Income: This section includes various sources of income, such as wages, dividends, and capital gains.

- Deductions: Taxpayers can choose between the standard deduction and itemizing deductions, which can significantly impact their taxable income.

- Tax and Credits: This section calculates the total tax owed and any applicable credits that can reduce the tax liability.

- Payments: Taxpayers report any tax payments made throughout the year, including withholding and estimated payments.

Filing Process: Step-by-Step

Filing Form 1040 can seem daunting, but breaking it down into manageable steps can simplify the process:

- Gather Documentation: Collect all necessary documents, including W-2s, 1099s, and receipts for deductions.

- Choose a Filing Method: Decide whether to file electronically or by mail. E-filing is generally faster and more secure.

- Complete the Form: Fill out Form 1040 accurately, ensuring all information is correct.

- Review and Submit: Double-check all entries for accuracy before submitting the form to the IRS.

Common Mistakes to Avoid

Even seasoned taxpayers can make mistakes when filing Form 1040. Here are some common pitfalls to avoid:

- Incorrect Social Security Numbers: Ensure that all SSNs are accurate to avoid processing delays.

- Math Errors: Double-check calculations to prevent underpayment or overpayment of taxes.

- Missing Signatures: Remember to sign and date the form before submission.

- Ignoring Deadlines: Be aware of filing deadlines to avoid penalties and interest.

Conclusion

Form 1040 is a vital component of the US tax system, serving as the primary means for individuals to report their income and fulfill their tax obligations. Understanding its components, the filing process, and common mistakes can empower taxpayers to navigate their tax responsibilities more effectively. By staying informed and organized, individuals can maximize their potential refunds and ensure compliance with tax laws. For more detailed information, you can visit the official IRS website at IRS Form 1040.