-

Table of Contents

Understanding the Benefits of Having 2 Health Insurance Plans

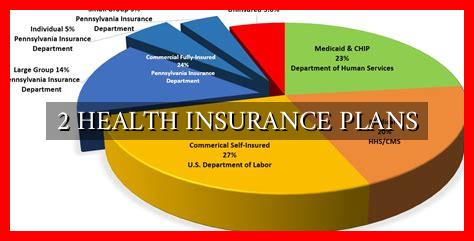

Health insurance is a crucial aspect of financial planning, providing coverage for medical expenses and ensuring access to quality healthcare. While many individuals have a single health insurance plan, there are instances where having two health insurance plans can offer additional benefits and coverage. In this article, we will explore the advantages of having 2 health insurance plans and how it can provide comprehensive coverage for individuals and families.

Primary and Secondary Health Insurance Plans

Having two health insurance plans typically involves having a primary insurance plan and a secondary insurance plan. The primary insurance plan is the first plan that pays for medical expenses, while the secondary insurance plan covers costs that are not covered by the primary plan. This arrangement can help individuals reduce out-of-pocket expenses and access a wider range of healthcare services.

Advantages of Having 2 Health Insurance Plans

- Increased Coverage: Having two health insurance plans can provide broader coverage for medical expenses, including services that may not be covered by a single plan.

- Reduced Out-of-Pocket Costs: With two insurance plans, individuals can lower their out-of-pocket expenses by having both plans contribute to covering medical costs.

- Access to More Providers: Dual insurance coverage can offer access to a wider network of healthcare providers, allowing individuals to choose the best providers for their needs.

- Coordination of Benefits: When coordinating benefits between two insurance plans, individuals can maximize coverage and ensure that all medical expenses are covered.

Case Study: John’s Experience with 2 Health Insurance Plans

John, a 45-year-old individual, had both employer-sponsored health insurance and coverage through his spouse’s employer.

. When John needed surgery, his primary insurance plan covered most of the costs, but there were still some out-of-pocket expenses. However, his secondary insurance plan stepped in and covered the remaining costs, reducing John’s financial burden significantly.

Considerations When Having 2 Health Insurance Plans

While having two health insurance plans can offer benefits, there are some considerations to keep in mind:

- Check for coordination of benefits to avoid overpayment or duplication of coverage.

- Understand the coverage limits and exclusions of each plan to ensure comprehensive coverage.

- Be aware of any restrictions on using both plans for the same medical service or treatment.

Conclusion

Having 2 health insurance plans can provide individuals and families with increased coverage, reduced out-of-pocket costs, and access to a wider range of healthcare services. By understanding the benefits and considerations of having dual insurance coverage, individuals can make informed decisions about their health insurance needs. Consider exploring the option of having 2 health insurance plans to maximize coverage and financial protection.