-

Table of Contents

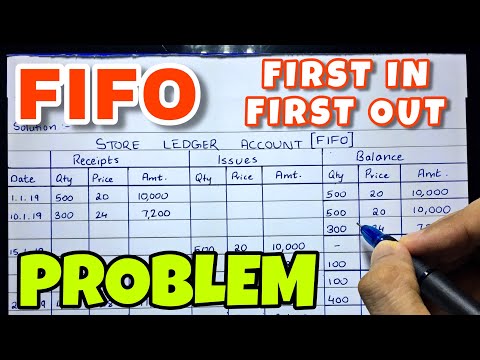

LIFO FIFO Problems with Solutions

Inventory management is a critical aspect of any business, and two common methods used to track inventory are LIFO (Last In, First Out) and FIFO (First In, First Out). While both methods have their advantages, they also come with their own set of challenges. In this article, we will explore some of the problems that can arise with LIFO and FIFO, as well as provide solutions to mitigate these issues.

Problems with LIFO

LIFO is a method of inventory valuation where the last items purchased are the first to be sold. While this method can be beneficial for tax purposes, it can also lead to several problems:

- Higher carrying costs: Since the newest and often more expensive inventory is being sold first, businesses may end up carrying older, potentially obsolete inventory for longer periods. This can result in higher carrying costs and reduced profitability.

- Lower reported profits: LIFO can lead to lower reported profits, as the cost of goods sold is based on the most recent, higher-priced inventory.

. This can impact financial ratios and investor perception of the company.

- Complexity in tracking inventory: LIFO can be more complex to track and manage compared to FIFO, as it requires detailed records of inventory purchases and sales.

Problems with FIFO

FIFO, on the other hand, is a method where the oldest inventory is sold first. While FIFO can help in maintaining a more accurate cost of goods sold, it also has its own set of challenges:

- Higher tax liabilities: FIFO can result in higher tax liabilities, especially during periods of rising prices, as the cost of goods sold is based on older, lower-priced inventory.

- Risk of obsolescence: FIFO can increase the risk of inventory obsolescence, as older inventory may remain in stock for longer periods, leading to potential write-offs.

- Reduced cash flow: FIFO can impact cash flow, as it may tie up capital in older inventory that is not selling as quickly as newer inventory.

Solutions

While both LIFO and FIFO have their drawbacks, there are several solutions that businesses can implement to address these issues:

- Regular inventory audits: Conducting regular inventory audits can help businesses identify slow-moving or obsolete inventory and take necessary actions to reduce carrying costs.

- Implementing inventory management software: Utilizing inventory management software can streamline the tracking and management of inventory, making it easier to monitor stock levels and sales trends.

- Utilizing a hybrid approach: Some businesses may benefit from using a combination of LIFO and FIFO methods for different product lines or inventory categories, depending on their specific needs and market conditions.

By addressing the challenges associated with LIFO and FIFO through these solutions, businesses can optimize their inventory management practices and improve overall profitability.

Conclusion

In conclusion, while LIFO and FIFO are widely used inventory valuation methods, they can present challenges that impact a business’s financial performance and operational efficiency. By understanding the problems associated with LIFO and FIFO and implementing the solutions discussed in this article, businesses can overcome these challenges and achieve better inventory management outcomes. It is essential for businesses to regularly review their inventory management practices and make adjustments as needed to ensure optimal performance and profitability.