-

Table of Contents

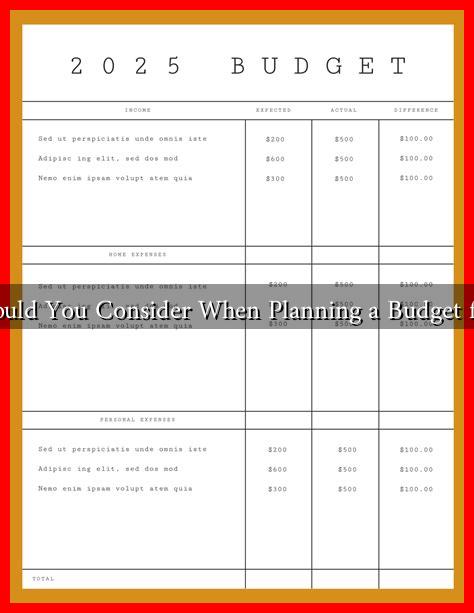

What Should You Consider When Planning a Budget for 2025?

As we approach 2025, effective budgeting becomes increasingly crucial for individuals and businesses alike. A well-structured budget not only helps in managing finances but also prepares you for unforeseen circumstances. This article will explore key considerations for planning a budget for 2025, ensuring you are well-equipped to make informed financial decisions.

Understanding Your Financial Goals

Before diving into numbers, it’s essential to clarify your financial goals. These goals will guide your budgeting process and help you prioritize your spending. Consider the following:

- Short-term Goals: These may include saving for a vacation, paying off debt, or building an emergency fund.

- Long-term Goals: Think about retirement savings, purchasing a home, or funding education for children.

- Investment Goals: Determine if you want to invest in stocks, real estate, or other assets to grow your wealth.

According to a survey by the National Endowment for Financial Education, 70% of Americans do not have a budget, which can lead to financial stress. Setting clear goals can help you stay focused and motivated.

Assessing Your Current Financial Situation

Understanding where you currently stand financially is crucial for effective budgeting. This involves:

- Income Analysis: Calculate your total monthly income, including salary, bonuses, and any side hustles.

- Expense Tracking: Review your monthly expenses, categorizing them into fixed (rent, utilities) and variable (entertainment, dining out).

- Debt Evaluation: List all debts, including credit cards, loans, and mortgages, along with their interest rates.

Utilizing budgeting tools like Mint or YNAB (You Need A Budget) can help streamline this process and provide insights into your spending habits.

Inflation and Economic Trends

As you plan your budget for 2025, it’s vital to consider the economic landscape, particularly inflation rates and market trends. The U.S. Bureau of Labor Statistics reported that inflation rates have fluctuated significantly in recent years, impacting purchasing power. Here are some factors to consider:

- Projected Inflation Rates: Research forecasts for inflation in 2025 to adjust your budget accordingly.

- Interest Rates: Monitor changes in interest rates, especially if you have variable-rate loans.

- Market Trends: Stay informed about trends in your industry or sector that may affect your income or expenses.

For instance, if inflation is expected to rise, you may need to allocate more funds for essential goods and services.

Emergency Fund and Savings

Building an emergency fund is a critical component of any budget. Financial experts recommend saving three to six months’ worth of living expenses. Consider the following when planning your emergency fund:

- Monthly Contributions: Determine how much you can set aside each month to reach your goal.

- Accessibility: Choose a savings account that offers easy access to your funds in case of emergencies.

- Automate Savings: Set up automatic transfers to your savings account to ensure consistency.

According to a report by Bankrate, only 39% of Americans can cover a $1,000 emergency expense, highlighting the importance of having a robust emergency fund.

Review and Adjust Regularly

Budgeting is not a one-time task; it requires regular review and adjustments. Here’s how to stay on track:

- Monthly Reviews: Set aside time each month to review your budget, comparing actual spending to your planned budget.

- Adjust for Changes: If your income or expenses change, adjust your budget accordingly.

- Seek Professional Advice: Consider consulting a financial advisor for personalized guidance.

Regular reviews can help you identify areas where you can cut back or reallocate funds to better meet your goals.

Conclusion

Planning a budget for 2025 requires careful consideration of your financial goals, current situation, economic trends, and the importance of an emergency fund. By taking a proactive approach and regularly reviewing your budget, you can navigate the financial landscape with confidence. Remember, a well-planned budget is not just about restricting spending; it’s about empowering you to make informed financial decisions that align with your aspirations. For more resources on budgeting, consider visiting Consumer Financial Protection Bureau.