-

Table of Contents

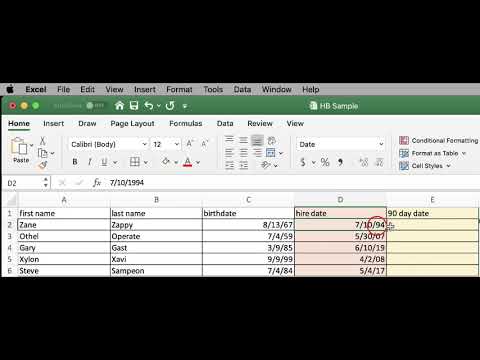

90 Days Before 30 June 2024: Planning for Financial Success

As we approach the end of the financial year, it is crucial for individuals and businesses to stArt planning ahead to ensure financial success. With just 90 days left before 30 June 2024, there are several key actions that can be taken to maximize tax benefits, optimize investments, and set financial goals for the upcoming year. In this article, we will explore the importance of planning ahead, provide actionable tips, and discuss the benefits of proactive financial management.

The Importance of Planning Ahead

Planning ahead is essential for financial success as it allows individuals and businesses to anticipate expenses, maximize tax benefits, and make informed decisions about investments. By taking proactive steps, you can avoid last-minute rush, reduce stress, and set yourself up for a successful financial year ahead.

Key Actions to Take

- Evaluate your current financial situation: Take stock of your income, expenses, assets, and liabilities to get a clear picture of where you stand financially.

- Review your investments: Assess the performance of your investments and consider rebalancing your portfolio to optimize returns.

- Maximize tax benefits: Take advantage of tax deductions and credits by reviewing your tax situation and making any necessary adjustments before the end of the financial year.

- Set financial goals: Define your financial goals for the upcoming year and create a plan to achieve them, whether it’s saving for a major purchase, investing for retirement, or paying off debt.

Case Studies and Examples

Let’s look at a couple of case studies to illustrate the benefits of planning ahead:

Case Study 1: Individual Investor

John is a 35-year-old individual investor who wants to retire early. By reviewing his investments 90 days before 30 June 2024, he realizes that he can increase his Contributions to his Retirement account to take advantage of tax benefits and compound interest. By making this adjustment, John is able to accelerate his retirement savings and move closer to his goal of early retirement.

Case Study 2: Small Business Owner

Sarah is the owner of a small business that is looking to expand. By evaluating her financial situation 90 days before 30 June 2024, Sarah identifies areas where she can cut costs, increase revenue, and secure financing for the expansion. With a clear plan in place, Sarah is able to successfully grow her business and achieve her long-term goals.

Summary

Planning ahead is key to financial success, especially as we approach the end of the financial year. By taking proactive steps, such as evaluating your financial situation, reviewing investments, maximizing tax benefits, and setting financial goals, you can set yourself up for a successful year ahead. Remember, it’s never too early to start planning for your financial future!