-

Table of Contents

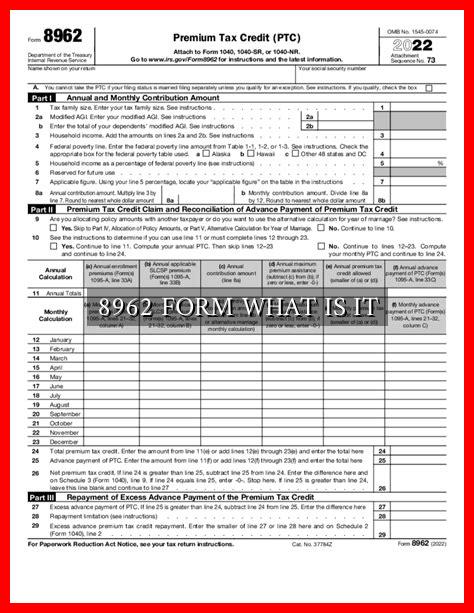

Understanding the 8962 Form: What is it?

When it comes to filing taxes, there are numerous forms and documents that individuals need to be aware of. One such form that often causes confusion is the 8962 form. In this article, we will delve into what the 8962 form is, why it is important, and how to properly fill it out.

What is the 8962 Form?

The 8962 form, also known as the Premium Tax Credit form, is used by individuals who have enrolled in a health insurance plan through the Health Insurance Marketplace. This form is used to reconcile the amount of premium tax credit that was advanced to them during the year with the actual amount they were eligible for based on their income.

Why is the 8962 Form Important?

It is crucial to accurately fill out the 8962 form as it determines whether you have received the correct amount of premium tax credit throughout the year. Failing to properly reconcile this amount can result in owing money back to the IRS or receiving a smaller tax refund than expected.

How to Fill Out the 8962 Form

When filling out the 8962 form, you will need to provide information about your household income, the number of individuals in your household, and the cost of your health insurance premiums.

. You will also need to indicate whether you received any advance premium tax credit payments during the year.

- Start by entering your personal information at the top of the form, including your name, address, and Social Security number.

- Next, fill out Part I of the form, which requires you to provide information about your household income and family size.

- Proceed to Part II, where you will calculate the premium tax credit you are eligible for based on your income and family size.

- If you received advance premium tax credit payments, you will need to complete Part III to reconcile the amount you received with the amount you were eligible for.

- Finally, review the form for accuracy and submit it along with your tax return.

Common Mistakes to Avoid

One common mistake individuals make when filling out the 8962 form is failing to accurately report their income. It is important to carefully review all sources of income, including wages, self-employment income, and investment income, to ensure that you are providing the correct information.

Another common mistake is forgetting to reconcile advance premium tax credit payments. If you received advance payments throughout the year, it is essential to accurately report this information on the form to avoid any discrepancies.

Conclusion

Understanding the 8962 form is essential for individuals who have enrolled in a health insurance plan through the Health Insurance Marketplace. By accurately filling out this form, you can ensure that you receive the correct amount of premium tax credit and avoid any potential issues with the IRS.

For more information on the 8962 form and how to properly fill it out, you can visit the IRS website.