-

Table of Contents

Understanding $62,000 After Tax in the U.S.

In today’s economic landscape, understanding your take-home pay is crucial for effective financial planning. For many, a salary of $62,000 may seem substantial, but the actual amount you take home after taxes can significantly impact your lifestyle and financial goals. This article delves into the implications of earning $62,000 after tax in the United States, exploring tax rates, cost of living, and financial strategies to maximize your income.

Breaking Down the Tax Implications

When discussing a salary of $62,000, it’s essential to understand how federal and state taxes affect your take-home pay. The U.S. tax system is progressive, meaning that higher income levels are taxed at higher rates.

. Here’s a breakdown of the key components:

- Federal Income Tax: The federal tax brackets for 2023 range from 10% to 37%. For a single filer earning $62,000, the effective tax rate is typically around 12% to 22%, depending on deductions and credits.

- State Income Tax: State taxes vary widely. Some states, like Florida and Texas, have no state income tax, while others, like California and New York, can have rates exceeding 10%.

- Social Security and Medicare: These payroll taxes amount to 7.65% of your income, which includes 6.2% for Social Security and 1.45% for Medicare.

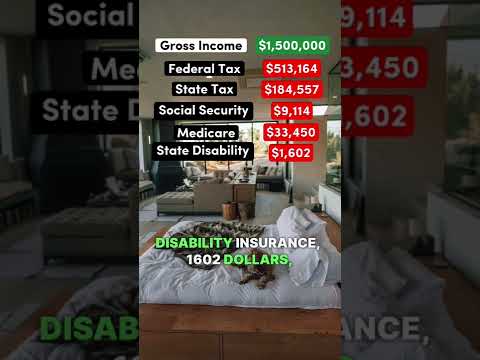

To illustrate, let’s assume a single filer in California with no additional deductions. The estimated tax breakdown might look like this:

- Federal Tax: Approximately $8,000

- State Tax: Approximately $3,000

- Social Security and Medicare: Approximately $4,743

After these deductions, the take-home pay would be around $46,257, significantly less than the gross salary of $62,000.

Cost of Living Considerations

Another critical factor to consider is the cost of living in different regions of the U.S. A salary of $62,000 may afford a comfortable lifestyle in some areas, while in others, it may barely cover basic expenses. Here are some examples:

- Affordable Cities: Cities like Omaha, Nebraska, and Richmond, Virginia, have a lower cost of living, making $62,000 more manageable.

- Expensive Cities: In cities like San Francisco or New York City, the same salary may not cover rent, utilities, and groceries, leading to financial strain.

According to the Numbeo Cost of Living Index, the cost of living can vary by as much as 50% between different cities, making it essential to consider where you live when evaluating your salary.

Financial Strategies for Maximizing Income

To make the most of a $62,000 salary after taxes, consider implementing the following financial strategies:

- Budgeting: Create a detailed budget to track your income and expenses. Tools like Mint or YNAB (You Need A Budget) can help.

- Emergency Fund: Aim to save at least three to six months’ worth of living expenses in an easily accessible account.

- Retirement Savings: Contribute to a 401(k) or IRA to take advantage of tax benefits and compound interest.

- Investing: Consider investing in low-cost index funds or ETFs to grow your wealth over time.

Conclusion

Understanding the implications of earning $62,000 after tax in the U.S. is vital for effective financial planning. With varying tax rates and cost of living across the country, this salary can mean different things to different individuals. By being aware of your tax obligations and implementing sound financial strategies, you can maximize your take-home pay and work towards achieving your financial goals. Whether you’re living in an affordable city or a high-cost area, careful planning and budgeting can help you make the most of your income.