-

Table of Contents

Understanding the 529 Plan: A Comprehensive Guide

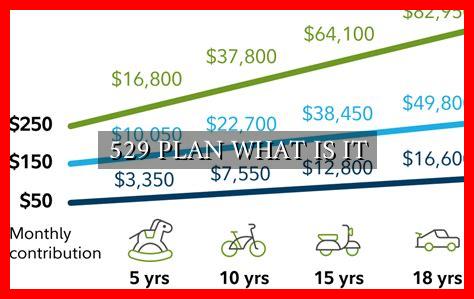

Planning for your child’s education can be a daunting task, especially when considering the rising costs of college tuition. One popular tool that many families use to save for their children’s education is the 529 plan. In this article, we will delve into what a 529 plan is, how it works, and why it may be a smart investment for your family’s future.

What is a 529 Plan?

A 529 plan is a tax-advantaged savings plan designed to help families save for future education expenses. These plans are sponsored by states, state agencies, or educational institutions and are named after Section 529 of the Internal Revenue Code, which governs their tax treatment.

How Does a 529 Plan Work?

When you contribute to a 529 plan, your money is typically invested in mutual funds or similar investment vehicles. The earnings on your contributions grow tax-deferred, meaning you do not pay taxes on the investment gains as long as the funds remain in the account.

. Additionally, withdrawals from a 529 plan for qualified education expenses are tax-free at the federal level.

Types of 529 Plans

- College Savings Plans: These plans allow you to save for any qualified higher education expenses, including tuition, fees, books, and room and board.

- Prepaid Tuition Plans: These plans allow you to prepay tuition at eligible colleges and universities at today’s prices, locking in the cost of education.

Benefits of a 529 Plan

There are several benefits to investing in a 529 plan:

- Tax advantages: Earnings grow tax-deferred and withdrawals are tax-free when used for qualified education expenses.

- Flexibility: Funds can be used at eligible colleges, universities, and trade schools nationwide.

- Control: The account owner retains control over the funds and can change beneficiaries if needed.

Case Study: The Smith Family

Let’s consider the Smith family, who started a 529 plan for their daughter, Emily, when she was born. They contributed $200 per month to the plan for 18 years, totaling $43,200. With an average annual return of 6%, the account grew to over $70,000 by the time Emily was ready for college. Thanks to the tax advantages of the 529 plan, the Smiths were able to cover Emily’s tuition and expenses without incurring additional taxes.

Conclusion

Investing in a 529 plan can be a smart way to save for your child’s education while taking advantage of tax benefits. By starting early and consistently contributing to the plan, you can help alleviate the financial burden of higher education expenses. Consider speaking with a financial advisor to determine the best 529 plan option for your family’s needs and goals.

For more information on 529 plans, visit SEC’s guide to 529 plans.