-

Table of Contents

Understanding the 529 Plan in Florida

When it comes to saving for your child’s education, the 529 plan is a popular choice for many families. In the state of Florida, the 529 plan offers a tax-advantaged way to save for future Education expenses. Let’s delve into the details of the 529 plan in Florida and how it can benefit you and your child.

What is a 529 Plan?

A 529 plan is a tax-advantaged savings plan designed to help families save for future education expenses. These plans are sponsored by states, state agencies, or educational institutions and offer various investment options to help grow your savings over time. The funds in a 529 plan can be used for qualified education expenses, such as tuition, fees, books, and room and board.

Types of 529 Plans in Florida

In Florida, there are two main types of 529 plans available:

- Florida Prepaid College Plan: This plan allows families to prepay for future college tuition and fees at today’s prices. It offers various payment options to suit different budgets and needs.

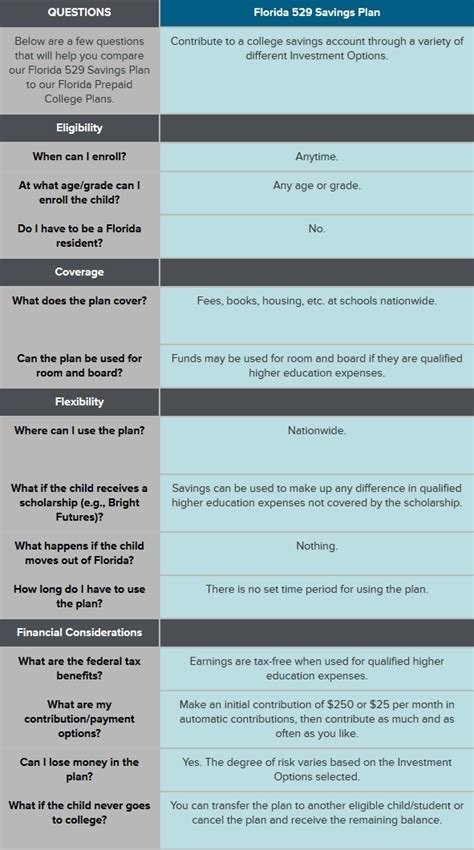

- Florida 529 Savings Plan: This plan allows families to invest in a variety of investment options to help grow their savings over time. The funds can be used for any qualified education Expenses at eligible institutions nationwide.

Benefits of a 529 Plan in Florida

There are several benefits to investing in a 529 plan in Florida:

- Tax advantages: Contributions to a 529 plan are made with after-tax dollars, but the earnings grow tax-free. Withdrawals for qualified education expenses are also tax-free.

- Flexibility: Funds in a 529 plan can be used at eligible institutions nationwide, not just in Florida. This gives families the flexibility to choose the best educational option for their child.

- Control: The account owner retains control over the funds in a 529 plan and can change the beneficiary if needed.

Case Study: The Smith Family

Let’s consider the Smith family, who started a 529 plan for their daughter, Emily, when she was born. They contributed regularly to the plan over the years, taking advantage of the tax benefits and investment growth. When Emily turned 18 and was ready to attend college, the Smiths were able to use the funds in the 529 plan to cover her tuition, fees, and other expenses, saving them thousands of dollars in taxes.

Statistics on 529 Plans in Florida

According to the College Savings Plans Network, Florida residents have saved over $10 billion in 529 plans as of 2021. This shows the popularity and effectiveness of these plans in helping families save for education expenses.

Conclusion

Overall, the 529 plan in Florida is a valuable tool for families looking to save for their child’s education. With tax advantages, flexibility, and control, these plans offer a smArt way to invest in your child’s future. Consider starting a 529 plan today to secure your child’s education and financial well-being.