-

Table of Contents

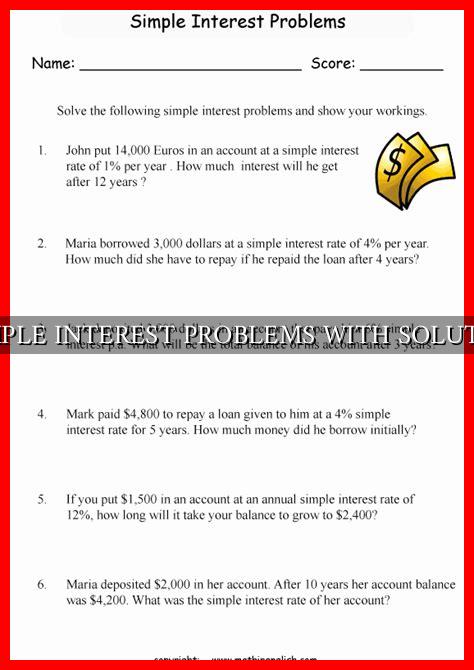

5 Simple Interest Problems with Solutions

Understanding simple interest is essential for managing finances and making informed decisions about loans, investments, and savings. Simple interest is calculated based on the principal amount, the interest rate, and the time period. In this article, we will explore five common simple interest problems and provide solutions to help you grasp this concept better.

Problem 1: Calculating Simple Interest

One of the fundamental problems involving simple interest is calculating the total amount accrued over a specific period. The formula for calculating simple interest is:

Simple Interest = Principal x Rate x Time

For example, if you borrow $1,000 at an interest rate of 5% for 3 years, the simple interest can be calculated as follows:

- Principal = $1,000

- Rate = 5%

- Time = 3 years

Using the formula, Simple Interest = $1,000 x 0.05 x 3 = $150

Therefore, the total amount to be repaid after 3 years would be $1,000 + $150 = $1,150.

Problem 2: Finding the Principal Amount

Another common problem involves finding the principal amount when the simple interest, rate, and time are known. The formula for calculating the principal amount is:

Principal = Simple Interest / (Rate x Time)

For instance, if the simple interest is $200, the interest rate is 8%, and the time period is 2 years, the principal amount can be calculated as follows:

- Simple Interest = $200

- Rate = 8%

- Time = 2 years

Using the formula, Principal = $200 / (0.08 x 2) = $1,250

Therefore, the initial principal amount borrowed was $1,250.

Problem 3: Determining the Interest Rate

Calculating the interest rate is another common problem in simple interest calculations.

. The formula for finding the interest rate is:

Rate = Simple Interest / (Principal x Time)

For example, if the simple interest is $300, the principal amount is $5,000, and the time period is 4 years, the interest rate can be calculated as follows:

- Simple Interest = $300

- Principal = $5,000

- Time = 4 years

Using the formula, Rate = $300 / ($5,000 x 4) = 0.015 or 1.5%

Therefore, the interest rate for this loan is 1.5%.

Problem 4: Time Period Calculation

Calculating the time period is crucial for understanding how long it will take for the interest to accrue. The formula for finding the time period is:

Time = Simple Interest / (Principal x Rate)

For instance, if the simple interest is $400, the principal amount is $10,000, and the interest rate is 4%, the time period can be calculated as follows:

- Simple Interest = $400

- Principal = $10,000

- Rate = 4%

Using the formula, Time = $400 / ($10,000 x 0.04) = 1 year

Therefore, it will take 1 year for the interest to accrue to $400.

Problem 5: Total Amount Calculation

Calculating the total amount to be repaid is essential for budgeting and financial planning. The formula for finding the total amount is:

Total Amount = Principal + Simple Interest

For example, if you invest $2,500 at an interest rate of 6% for 5 years, the total amount can be calculated as follows:

- Principal = $2,500

- Rate = 6%

- Time = 5 years

Using the formula, Total Amount = $2,500 + ($2,500 x 0.06 x 5) = $3,500

Therefore, the total amount to be repaid after 5 years would be $3,500.

Summary

In conclusion, simple interest problems are essential for understanding financial transactions and making informed decisions. By mastering these five simple interest problems and their solutions, you can improve your financial literacy and make better financial choices. Remember to use the formulas provided in this article to solve similar problems in real-life scenarios.

For more information on simple interest calculations and financial literacy, you can visit Investopedia.